1. US-China trade war intensifies: The Trump Administration's latest round of tariffs on Chinese goods have kicked in, drawing immediate retaliation from Beijing.

The new exchange of fire between the two economic superpowers comes as officials from both countries hold talks in Washington over the dispute.

The United States imposed 25% tariffs on another $16 billion of Chinese goods just after midnight ET Thursday -- midday in Beijing. The tax affects 279 Chinese products, including chemical products and motorcycles.

China responded immediately with 25% tariffs on an equal amount of American goods, such as chemical products and diesel fuel.

Both China and the United States have now imposed tariffs on $50 billion of each other's goods in the clash, which the Trump administration launched in an effort to punish China for what it says are unfair trade practices.

The US Federal Reserve warned this week that a "major escalation" of trade disputes could speed American inflation and cause businesses to pull back on investment.

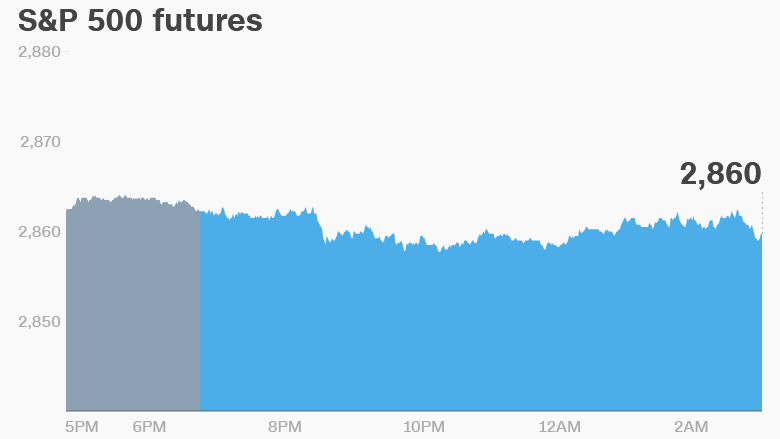

2. Global market overview: US stock futures were steady. Commodity prices dipped, led by metals.

European stock markets inched higher in early trading. Asian markets ended mixed.

The Dow Jones industrial average dripped 0.3% on Wednesday, while the S&P 500 was flat and the Nasdaq rose 0.4%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Ryanair stock takes off: Shares in Ryanair (RYAAY) rose 6.5% after the airline said it reached a labor agreement with the Irish pilot union, Forsa.

The company recognized unions in late 2017 and began negotiating on issues including wages and working conditions. If the Irish pilots vote in favor of the deal, it would be the first time the discount airline has signed a collective labor agreement with any of its pilots.

Investors hope the deal signals the end a string of damaging summer strikes. Other pilot unions in countries including Germany and Spain are also negotiating with Ryanair.

4. Earnings and economics: Alibaba (BABA), Hormel Foods (HRL) and The Children's Place (PLCE) will release earnings before the US open.

Gap (GPS), HP (HPQ) and Intuit (INTU) are set to release earnings after the close.

Shares in Australian airline Qantas dipped 3% as investors reacted to earnings that showed the company is getting squeezed by higher fuel costs.

The annual Jackson Hole Economic Symposium — a major event for central bankers — kicks off on Thursday. Federal Reserve Chairman Jerome Powell is speaking at the event on Friday.

The US Census Bureau will publish June data on new home sales at 10 a.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

5. Coming this week:

Thursday — Alibaba (BABA), HP (HPQ), Ross Stores (ROST) and Gap (GPS) earnings

Friday — Foot Locker (FL)earnings