1. Tesla to remain public: Shares in Tesla were poised to slump 5% on Monday after CEO Elon Musk said that he had given up on plans to take the electric-car company private.

There was heavy trading in Tesla (TSLA) stock ahead of the opening bell.

The billionaire entrepreneur stunned investors earlier this month when he tweeted that he had secured funding to remove the firm from the stock market.

Shares in Tesla jumped about 11% on August 7, the day Musk tweeted about his plan to take the company private. But the stock has tumbled 15% since then as doubts mounted and regulators reportedly looked into whether funding had been secured.

Musk said his change of heart came after talking to Tesla investors and realizing that taking the company private would be harder than he originally thought.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. NAFTA breakthrough? The United States and Mexico could be nearing a deal after weeks of bilateral talks over NAFTA, the key North American trade agreement that's faced an uncertain fate for more than a year.

Reuters reported Sunday that Mexico's Economy Minister Ildefonso Guajardo said the talks were in the "final hours."

On Saturday, President Donald Trump said in a tweet that America's "relationship with Mexico is getting closer by the hour" and that "a big Trade Agreement with Mexico could be happening soon!"

3. Didi in trouble: Didi Chuxing is suspending one of its services for the second time this year after a driver was accused of raping and killing a female passenger.

China's biggest ride-hailing company apologized for "disappointing mistakes" and said that two senior managers have been removed from their jobs.

SoftBank (SFTBF) and Apple (AAPL) are among the companies that have invested in Didi. Uber also ended up with a big stake in exchange for its China operations, which it sold to Didi in 2016.

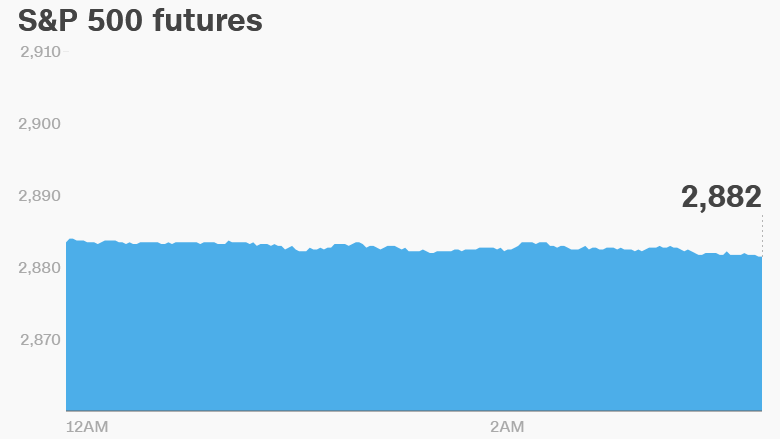

4. Global stock market overview: US stock futures were higher, suggesting that Monday could be another record-setting day on Wall Street.

The S&P 500 rallied by 0.6% on Friday to hit an all-time high. The Nasdaq added 0.9% to hit a record high of its own. The Dow Jones industrial average surged 0.5%, but remains below its January peak.

European markets were mostly positive in early trading. UK stock markets were closed for a holiday.

Asian markets ended with gains.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

5. Coming this week:

Tuesday — Best Buy (BBY), H&R Block (HRB), Box (BOX) and Tiffany (TIF) earnings; US home price data released for June

Wednesday — Salesforce (CRM) and Brown-Forman (BFA) earnings

Thursday — Abercrombie & Fitch (ANF), Campbell Soup (CPB), Lululemon (LULU) and Dollar Tree (DLTR) earnings

Friday — Eurozone unemployment data released for July