1. Central banks take the stage: Turkey's central bank hiked interest rates to 24% from 17.75% in a move that could help calm fears about emerging markets.

In hiking rates, the central bank sent the lira soaring against the US dollar and delivered a rebuke to President Recep Tayyip Erdogan, who on Thursday described interest rates as "tools of exploitation."

Turkey and Argentina have been under intense pressure in recent months as their currencies plunged. Not even an IMF bailout and interest rates of 60% have stemmed the bleeding in Argentina.

Investors worry that the trouble could spread, infecting other vulnerable markets or even Wall Street.

Also on Thursday, the Bank of England and the European Central Bank left interest rates unchanged. The ECB said it expects rates to remain at current levels through summer 2019.

2. Kroger earnings: America's largest grocery chain will report its quarterly earnings before the bell.

Kroger (KR) has stepped up its efforts to push back against online competition. It has launched forays into China, a home delivery service and visions of a plastic-bag-free future last month alone.

Earlier this year, it signed an exclusive deal with UK online supermarket Ocado to use its technology in the United States.

Traditional retailers are struggling to keep up with the changing habits of their shoppers. British department store John Lewis provided another example on Thursday, reporting a 99% drop in profits in the first half of the year.

3. China trade talks: The Trump administration has offered China a new chance to talk trade as US officials prepare to impose steep tariffs on a huge range of Chinese goods. The Chinese Commerce Ministry said it welcomed the invitation.

President Donald Trump said last week that new tariffs on $200 billion of Chinese goods could go into effect "very soon" and warned that another, even bigger wave of measures is "ready to go on short notice if I want."

The two economic superpowers have already imposed tariffs of 25% on more than $50 billion of each other's exports.

4. No deal Brexit planning: The UK government is holding a cabinet meeting to plan for life after Brexit and consider the implications of dropping out of the European Union without a deal.

It will then release another batch of notices advising businesses on how to prepare for a no-deal Brexit, an outcome that businesses have warned against.

The notices will include information on cell phone charges while traveling abroad and environmental standards.

The pound was flat against the dollar.

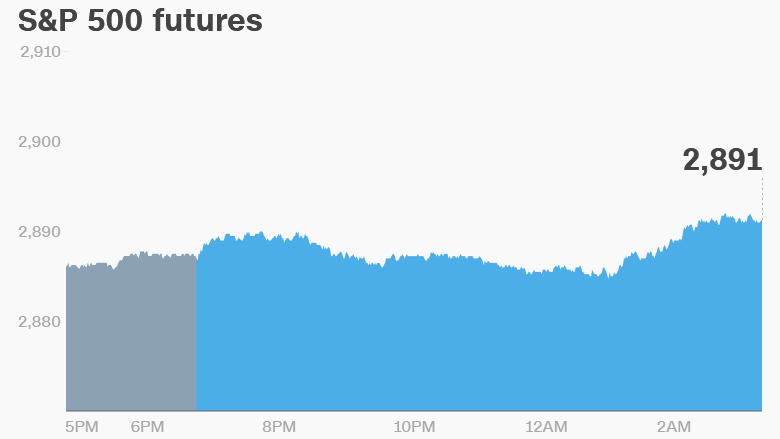

5. Global market overview: US stock futures were edging higher.

European markets opened mixed. Stocks in Asia ended with gains.

The Dow Jones industrial average closed 0.1% higher on Wednesday, while the S&P 500 was flat. The Nasdaq shed 0.2%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Earnings and economics: Adobe Systems (ADBE) will release earnings after the closing bell.

The US Bureau of Labor Statistics will publish its August CPI report at 8:30 a.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Thursday — Kroger reports earnings, US consumer inflation report, European and UK central banks report interest rate decisions

Friday — US retail sales and consumer sentiment reports