1. Trade war escalates: The Trump administration has announced a new round of tariffs on Chinese goods worth $200 billion that will go into effect next week.

President Donald Trump had urged his advisers to press forward with the tariffs, even as Washington and Beijing worked to restart trade talks.

Trump's decision threatens to upend the possibility of a diplomatic breakthrough with Chinese negotiators.

The United States will charge a 10% tariff on the imports, increasing to 25% at the end of the year. The additional tariffs are on top of penalties enacted earlier this year on $50 billion worth of Chinese goods. Taken together, it means roughly half of the products that China sells to the United States each year will be hit by American tariffs.

The Chinese government said it would retaliate.

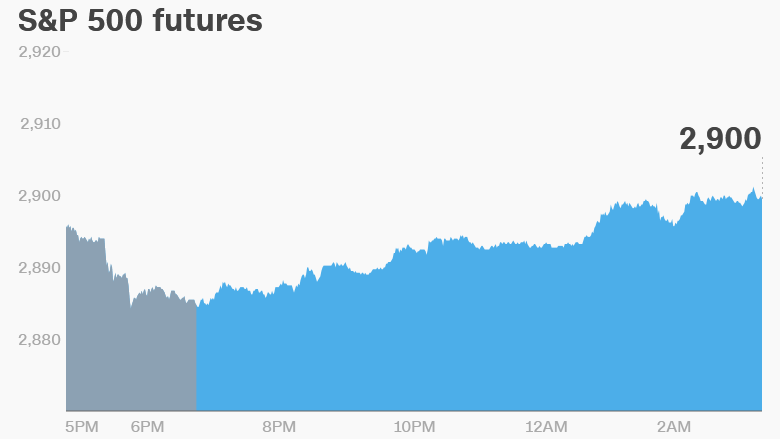

2. Global market overview: Markets were calm despite another escalation in the trade war between the world's two biggest economies.

US stock futures were pointing up and European markets opened mostly higher.

Asian markets ended the session mixed.

"It seems as if the latest tariff announcement was largely priced in," said Hussein Sayed, chief market strategist at FXTM.

The Dow Jones industrial average closed 0.4% lower on Monday, while the S&P 500 dropped 0.6%. The Nasdaq shed 1.4% in its worst day since late July.

3. Google goes driving: Google (GOOGL) will integrate its Android operating system into cars produced by Renault, Nissan and Mitsubishi under a partnership announced Tuesday.

The automakers will be able to install Google Maps, Google Play Store and Google Assistant in vehicles starting in 2021.

Renault (RNLSY), Nissan (NSANF) and Mitsubishi (MSBHY) are part of an alliance that sold 10.6 million vehicles last year.

Shares in TomTom (TMOAF), the Dutch maker of navigation and traffic products, dropped 24% in Amsterdam after the announcement.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Companies and economics: Autozone (AZO),Cracker Barrel (CBRL) and General Mills (GIS) will release earnings before the US open.

SpaceX has revealed that Yusaku Maezawa will be its first space tourist. The Japanese billionaire has chartered a flight aboard the company's Big Falcon Rocket, which is still being developed, for a slingshot trip around the Moon as soon as 2023.

Insurance broker Marsh & McLennan (MMC) said that it is buying rival Jardine Lloyd Thompson in a deal that values the company at $6.4 billion.

The World Economic Forum in Tianjin, known as the "summer Davos," got underway Tuesday as the United States and China sparred over trade.

The European Commission has opened a formal investigation into whether German carmakers BMW (BAYRY), Daimler (DDAIF) and Volkswagen (VLKAF) decided not to compete with each other on clean emission technology.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

5. Coming this week:

Tuesday — General Mills (GIS) and AutoZone (AZO) earnings; US Treasury foreign bond ownership stats

Thursday — Darden (DRI) Restaurants and Micron Technology (MU) earnings

Friday — S&P reclassification; new iPhones and Apple Watch hit stores