800-767-1729

Sure, investing in socially responsible mutual funds - those that eschew purveyors of tobacco, weapons and so forth - can make you feel all warm inside. But their average returns in recent years have been chilling.

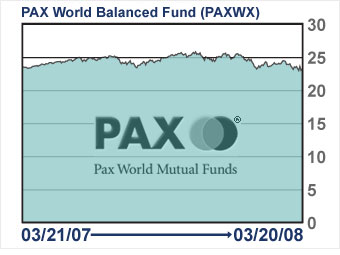

Not so with this fund, which invests in both stocks and bonds worldwide. It consistently beats the average moderate-allocation balanced fund (returning 9.4% vs. 5.9% in 2007), and it even bested the much riskier S&P 500 index over the past three years.

Its expense ratio also provides a reason to feel quite satisfied: At 0.96%, it's lower than that of most other socially responsible funds.

Join the Vanguard Charitable Endowment Program

888-383-4483

Let's say you want to take a big tax deduction this year by donating a slew of stock but you're not sure which charity to choose. Transfer your stocks to a donor-advised fund, take the deduction now and designate the recipient(s) later. If the fund increases in value, your charities benefit.

Because all major financial firms operate donor-advised funds in pretty much the same way, look for low fees. Vanguard's annual 0.57% is one of the lowest around, and you get access to eight investment pools of Vanguard funds. Minimum investment is $25,000.

- Joe Light, Money Magazine staff reporter

More galleries