The question will undoubtedly be asked, but the answer will be what it always is: Bear market bargains, so obvious in hindsight, look much too risky at the time.

However, if you are prepared to see today's battered stocks go even lower before they bounce back and if you venture only a sliver (say, less than 5%) of your portfolio on them, buying big losers could be a smart way to reap real upside from this mean market.

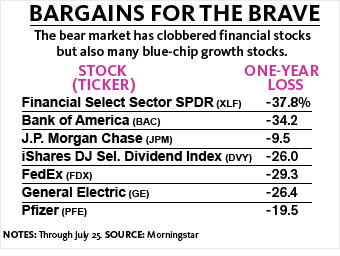

Dreman likes Bank of America and J.P. Morgan Chase. But other blue chips such as GE and FedEx are trading well below their peers' P/E ratios. A safer play is an ETF like the Financial Select Sector SPDR or the blue-chip iShares Dow Jones Select Dividend Index , which invests in many sectors.

NEXT: Buy low - the chicken way