The only 7 investments you need

It's a tough market, but don't think that means you need more weapons for your portfolio. Now more than ever, don't complicate your strategy. Simplify it.

Not so long ago, the idea that U.S. stocks should be at the core of any investment strategy would have been deemed too obvious to discuss. This decade, in which the brutal 2000-02 bear market and the current downturn have left the S&P 500 stuck where it started, may have changed that.

Let's review: Since 1967 there have been seven bear markets, with losses ranging from 19% to 49%. Even so, the annual gain for blue-chip U.S. stocks is 10.8% - far outpacing bonds. Those painful but temporary losses are the price you pay for higher potential returns.

And those gains are the best defense against the corrosive effects of inflation. Are stocks better than gold at whipping inflation? Way better: Since 1908, stocks have grown more than eightfold after inflation; gold has little more than doubled in today's dollars.

Although U.S. firms no longer dominate the world, their stocks still account for more than 40% of the world's equity value. So U.S. blue chips need to be at the heart of a diversified strategy.

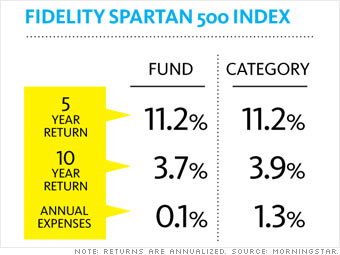

The best way to own them is through the Fidelity Spartan 500 Index fund. It replicates the performance of the S&P 500 and takes only a sliver of a fee for doing so: 0.10% a year.

Alternatives: iShares S&P 500 Index (IVV) and Selected American Shares (SLASX )

NEXT: A blue-chip foreign-stock fund