11 ways to save money now

Don't let this recession keep you down. Grab the opportunity to build a stronger portfolio, cut the fat from your budget, and give yourself a head-to-toe fiscal makeover.

As investors have been slowly shifting out of low-yielding Treasury bonds - the shelter of choice in last year's market storm - into higher-returning assets, Treasury prices have fallen this year. The result: Long-term government bond mutual funds are down 12.6% on average*, making them one of the poorest- performing fund categories year to date.

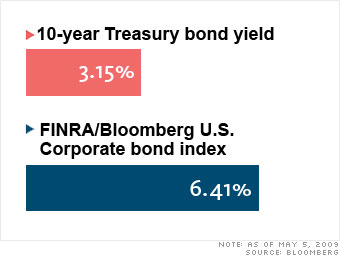

Worse, losses could continue if there are signs of an economic recovery or inflation ahead. So rebalance your fixed-income portfolio by shifting some money out of debt issued by Uncle Sam and putting it into other bonds. Both high-grade corporate bonds and high-quality municipals are offering much higher yields than Treasuries (corporates are yielding around twice as much).

In this environment, "no more than 20% of your bond portfolio should be in Treasuries," says New York financial planner Karen Altfest. An easy way to gain exposure to munis and corporate bonds is through a professionally managed fixed-income fund, such as those found in the Money 70, our recommended list of funds.

NEXT: Accept the new norm...

Last updated May 08 2009: 10:58 AM ET

*As of May 5