11 ways to save money now

Don't let this recession keep you down. Grab the opportunity to build a stronger portfolio, cut the fat from your budget, and give yourself a head-to-toe fiscal makeover.

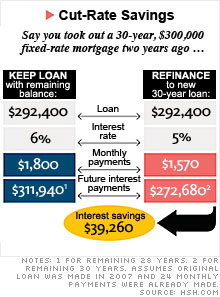

There are restrictions. Your new loan can't be greater than $417,000. In pricey markets like New York City, that figure goes up to $729,750. Rates on larger jumbo mortgages are a stiffer 6.4%.

Also, lenders are shifting back toward old standards. Your monthly mortgage, insurance, and taxes shouldn't eat up more than 31% of your monthly income, nor should your total monthly debt payments exceed 43%.

Before you forge ahead, make sure refinancing is worth it. Use the refinance calculator to run through your figures.

NEXT: Juice your credit score an extra 20 points

Last updated May 08 2009: 10:58 AM ET