Shales, massive rock formations deep below ground, may hold enough natural gas to satisfy U.S. needs for the next 45 years. Pure-play shale companies such as Range Resources (RRC) and Southwestern Energy (SWN) have seen their stocks rise 72% and 160%, respectively, over the past five years.

Why they're worrisome

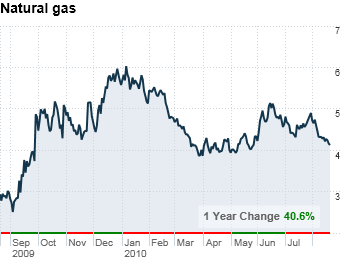

With gas prices already low -- $4.30 per million BTU -- these discoveries will add supply and further depress prices.

Verdict: a bubble

Environmental fears are fueling opposition to shale drilling. New York, where the massive Marcellus shale is partially located, is considering a temporary ban. Yet Range (a large Marcellus leaseholder) has a price/earnings ratio of 65 based on 2010 earnings, a huge premium to such diversified gas companies as Chesapeake and Devon, which have P/Es of 7 and 11, respectively. "Everyone is betting gas prices will go up," says Oppenheimer analyst Fadel Gheit. "But I don't see it."

NEXT: Cotton

Last updated August 23 2010: 2:56 PM ET