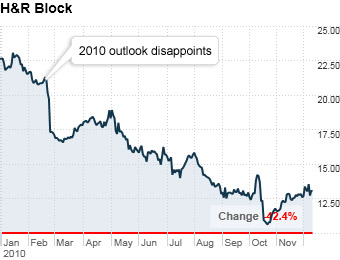

H&R Block heavily relies on tax-filing season to deliver healthy earnings, so when the nation's largest tax processor warned that high unemployment levels and fewer tax filings would cut into its profit, shares tanked.

H&R Block's stock slid further in May on news that it might wind up paying for bad loans it sold during the housing bubble, when it still owned subprime-mortgage originator Option One Mortgage.

And it's not just fallout from the housing crisis taking its toll on H&R Block's stock.

In August, the IRS said it would no longer provide tax prepares with so-called debt indicators -- used to issue tax-refund loans that last about two weeks until taxpayers receive their refunds from the government.

That problem worsened in October, when H&R Block said that it may not be able to offer the popular and profitable refund anticipation loans at all during the upcoming tax season because HSBC, its tax-refund loan provider, was not living up to its contract.

H&R Block sued the bank, but in a recent note to clients, Oppenheimer analyst Scott Schneeberger said the spat is still unsettled and a favorable outcome seems less likely.

NEXT: #6 Dean Foods