The nation's third-largest drugstore chain aimed high when it acquired Brooks/Eckerd in 2007 to challenge rivals Walgreen Co. and CVS Caremark. But the deal bogged Rite Aid down with debt just as the economy began to deteriorate and shoppers began tightening their purse strings, especially for medical services.

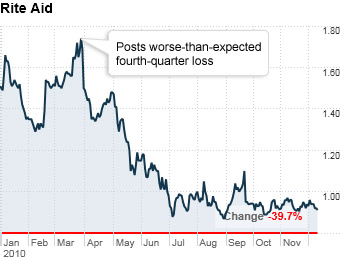

The company's stock fell dramatically after Rite Aid posted a worse-than-expected loss for its fiscal fourth-quarter, and lowered its guidance for fiscal 2011. As the year went on, the drugstore chain continued to post losses and issue bearish outlooks. Furthermore, Rite Aid's same-store sales, a key measure of performance, have declined for 18 straight months.

The weakness has forced Rite Aid to trim its operations. Over the course of the year, it has opened just four new locations and shut down more than 70 stores.

Last week, the company reported a $79 million loss for its 2011 third quarter, and again lowered its guidance for the remainder of its fiscal year, which ends in February.

NEXT: #7 H&R Block