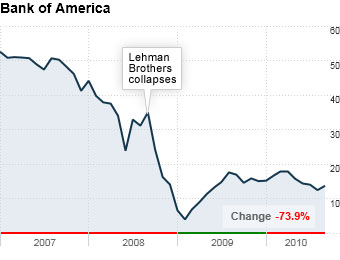

Bank of America's shares plunged more than 21% on Sept. 15, 2008 -- the day Lehman Brothers declared bankruptcy and the Charlotte, N.C.-based bank agreed to buy Merrill Lynch as the financial crisis intensified. In fact, Bank of America's stock sank more than 90% by the time the market bottomed in March 2009.

The stock has recovered some since then, but it suffered another hard hit this summer, when executives detailed how new Wall Street provisions -- particularly the so-called Durbin Amendment -- would impact fees that the bank collects from debit card swipes.

The pessimistic outlook initially spooked investors and drove the bank's stock price so low that it's now considered significantly undervalued, said Blake Howells, director of equity research for Becker Capital Management, which owns shares of Bank of America.

"The stock is trading at a price that is fairly cheap even by historical standards," he said. "We know Bank of America has significant exposure to regulations on debit interchange fees because it is so consumer oriented, but we think it will be able to offset the negatives with fees assessed on other product lines and additional cost-cutting measures."

With the risks already priced into the market, Howells said the stock is likely to head higher. In fact, he expects it to top $21 a share over the next few years as credit conditions normalize.

NEXT: Cullen/Frost Bankers: What bailout?