Search News

NEW YORK (CNNMoney.com) -- Have you looked at how big bank stocks have done in the past few months? If so, you can be forgiven if you break into a cold sweat and start worrying about a repeat of the fall of 2008.

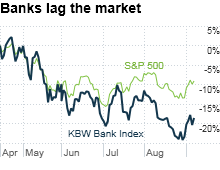

Shares of the top four U.S. commercial banks, JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500) and Wells Fargo (WFC, Fortune 500), have all taken a sharp plunge since mid-April. They have dropped 25% on average compared to a decline of 10% for the S&P 500. JPMorgan, BofA and Wells are now trading only about 10% above their 52-week lows

|

| Bank stocks have taken a beating in the past five months as concerns about the health of the global economy have resurfaced. |

Two other financial colossuses -- investment banks Goldman Sachs (GS, Fortune 500) and Morgan Stanley (MS, Fortune 500) -- have fared almost as poorly. They are down about 20%.

It's easy to understand why investors are worried that history may be repeating itself only two years after the banking sector spectacularly imploded.

Few are predicting a return to those dark days. But for a look at just how bad things could get if credit conditions were to become as dire as they were in the wake of the Lehman Brothers collapse, check out the chart at the top of this story. It features data from Hidden Levers.

Still, despite the best efforts of central bankers around the world, it's clear that the credit crisis is not completely over. Banks are still very reluctant to lend.

The sovereign debt problems in Europe have unsurprisingly spooked investors in the largest banks in the United Kingdom and on the continent. There are also fears that the bank stress tests done in Europe were far from stressful and that big banks there remain in trouble.

In the U.S., there are still legitimate concerns about credit quality and the so-called toxic assets that many banks have yet to dump.

"There are a lot of unknowns. What are the balance sheets of the banks really like? What do they own? That's an issue for many banks that clouds the issue. It's still very muddy," said Paul Nolte, managing director with Dearborn Partners, an investment firm based in Chicago.

With that in mind, Nolte said the only bank his firm owns is Northern Trust (NTRS, Fortune 500), a company that generates a big chunk of its profits from fees tied to managing the assets of wealthy individuals, and not from lending.

The credit woes may only get worse as unemployment stays stubbornly high and the housing market remains a mess. Banks may have to reckon with more bad loans tied to mortgages, credit cards and commercial real estate.

"The problem with the banks is they are so heavily weighted with real estate and they're basically gambling. They are holding all this property and waiting for prices to go up," said Keith Springer, president of Capital Financial Advisory Services in Sacramento, Calif.

"We're still dealing with the same issues form the past three years and that could create another crisis of confidence," Springer added.

There's also still a lot of uncertainty about what the recently passed Wall Street reform bill will do to the fundamentals of big banks over the next few years.

"It's too early to fully understand the impact from the Dodd-Frank bill. There are concerns about what will happen to bank revenue," said Blake Howells, director of equity research for Becker Capital Management in Portland. His firm owns shares of JPMorgan Chase and Bank of America as well as smaller banks PNC (PNC, Fortune 500) and U.S. Bancorp (USB, Fortune 500).

Goldman didn't do its peers any favors either. Financial regulators are likely to keep an even closer eye on the whole sector in the wake of claims from the SEC back in April that Goldman defrauded investors in a complex mortgage deal. (Goldman settled those charges without admitting wrongdoing in July.)

Sure, most of the big banks are once again profitable. And many are expected to report decent increases in earnings for the third and fourth quarters of this year.

But analysts have been busy hacking away at their earnings estimates for some of the major banks over the past few months.

At BofA, for example, analysts currently are forecasting a third quarter profit of 18 cents a share. Just two months ago though, the consensus was for a profit of 23 cents. That's a 22% haircut.

Profit targets have been lowered for Goldman and Morgan Stanley as well. That's not an encouraging sign. As Springer pointed out, banks may be in a no-win situation.

"If the economic recovery is for real, bank stocks are going to lag because they still have problems. But if this is another downturn, they would probably lead the sell-off," he said.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney.com, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |