Known as "the bank of the stars," Beverly Hills-based City National Bank boasts a wealthy client base that provides the regional bank with a nice cushion to outlast another credit crisis.

With more than $18 billion in deposits, an extraordinary 92% of them are from customers who have non-interest-bearing accounts.

That gives City National an advantage that has helped the bank aggressively pay back the $400 million it received in government bailout funds, and take over three failed banks in the last year.

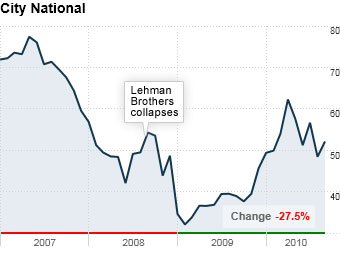

Plus, at its current price, the bank's stock is a pretty decent value, according to Jason Tyler, senior vice president and director of research operations at Ariel Capital Management, which own shares of City National. Tyler expects the bank's stock to climb almost 40% over the next two years to about $71 a share.

NEXT: US Bancorp: Dividend boost