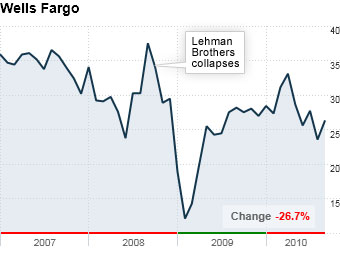

Shares of Wells Fargo have slowly recovered from a 13-month low hit just three weeks ago, but the stock is still selling at a fairly generous discount.

"The stock doesn't have Wells Fargo's positive attributes priced in," said Chris Bingaman, a portfolio manager at Diamond Hill Capital Management, which owns shares of the San Francisco-based bank. He expects the stock will surge almost 50% as the credit market improves.

With a litany of financial products, healthy profit margins and a diverse geographic base, Wells Fargo is on track to consistently post strong profits, Bingaman said.

And although Wall Street reforms will weigh on some of the bank's practices, Bingaman added that Wells Fargo will be less impacted in comparison to its rivals and will likely be able to mitigate the downside by adapting and continuing to generate profit from other business lines.

More galleries