He likes WisdomTree's Emerging Markets Local Debt ETF (ELD), which buys debt using local currencies in more than a dozen developing countries including Brazil, South Africa, Russia and South Korea.

Tom Lydon, president of Global Trends Investments and editor of ETFtrends.com, also likes high-yield corporate bonds, or junk bonds, saying many firms are "solidly positioned" with trillions of dollars in cash on their balance sheets. And global junk bond default rates hit a two-year low of 3.3% last month, according to Moody's Investors Service.

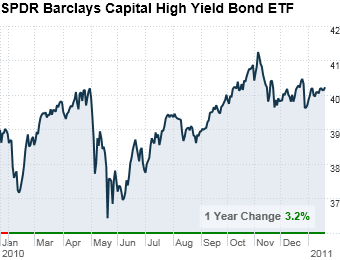

Lydon said SPDR Barclays Capital High Yield ETF (JNK), which yields nearly 9%, is a solid option. SPDR Barclays' holdings includes CIT Group (CIT) and AIG (AIG).

Don't buy: While U.S. government debt is typically considered a fairly safe bet, Lydon said investors should be cautious. As the economic recovery gets in full gear, the Federal Reserve will have to raise interest rates from their historically low level. That will drive bond prices lower so investors holding onto long-term bonds stand to lose some of their principal.

He suggests staying away from funds like iShares Barclays 20-year Treasury Bond ETF (TLT). It tracks the Barclays Capital U.S. 20 Year Treasury Bond index, which measures the performance of U.S. Treasury securities that have a remaining maturity of at least 20 years.

More galleries