Search News

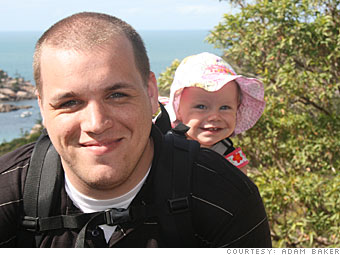

His situation: When Adam and his wife got engaged, they had $55,000 in student debt and $17,000 in consumer debt spread among three credit cards, two auto loans and a loan for their engagement ring.

His strategy: Sell almost all of their belongings.

After their first daughter was born, Adam said he had a wake-up call. He and his wife decided to sell pretty much everything they owned -- furniture, books, blenders, video games, baby cribs and wedding presents -- and paid off all $17,000 in consumer debt.

His advice: Figure out what you really need. Get rid of everything else.

How he's doing now: Adam and his wife have been road-tripping across the U.S. in an RV for the past six months. They have kept their possessions and clutter so low they can fit everything they own in the RV. They are still able to grow their business, a website that helps people get out of debt, from the road.

During this six-month period, he and his wife have paid off around $5,000 of their student loans. They now have $45,000 left to go, and no other debt.

"We pay extra each month, but are also focused on saving money and investing in our business -- meaning we don't put every extra dollar into the debt," he said.

From sleeping in offices to following senior citizens to restaurants in order to find the best "early bird specials," these people will do almost anything to save a buck.