Search News

We're no longer maintaining this page.

For the latest business news and markets data, please visit CNN Business

Show your portfolio some love this Valentine's Day with Berkshire Hathaway and five other sweetheart stock picks. They're fairly valued, have clean balance sheets and good long-term prospects.

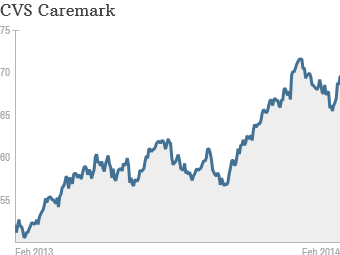

Drugstore stocks aren't exactly sexy, but there's a lot to love about CVS (CVS).

Shares of CVS and rival drugstore chain Walgreens (WAG) have rallied as investors bet that increased access to health insurance under Obamacare will lead to more demand for prescription drugs.

But CVS is also a major pharmacy benefit manager, meaning it helps the insurance industry process prescriptions. It has been setting up in-store clinics in some of its 7,600 stores, a move designed to meet growing demand for primary health care.

In addition, CVS is looking to boost sales by revamping the front end of its stores to look more like a mini-supermarket.

Related: CVS wants to play doctor with you

But there's one thing customers won't be able to buy at CVS for much longer: cigarettes. The company recently announced plans to stop selling tobacco, saying it was inconsistent with its mission.

The move will result in $2 billion of lost revenue, but CVS is still highly profitable. It reported quarterly earnings that beat analysts' expectations this week and raised its outlook for the year.