Search News

We're no longer maintaining this page.

For the latest business news and markets data, please visit CNN Business

The bull market in stocks turns 6 years old in March. Investors in these funds made a lot of money.

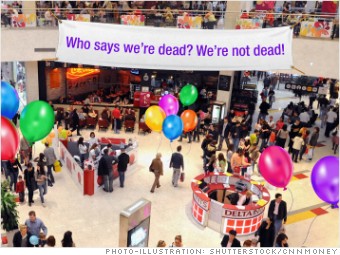

Malls aren't dead yet.

Yes, Americans are increasingly turning to the Internet to get their shopping done. And yes, some mall brands like RadioShack are near death and others like Wet Seal (WTSLQ) have filed for bankruptcy.

But real-estate investment trusts, or REITs, that own malls have raced back from the financial crisis. (Investors love REITs because they usually don't pay corporate taxes and return at least 90% of their income as dividends).

For example, Simon Property Group (SPG), which owns the Galleria in Houston, has skyrocketed 700% since March 2009.

Related: Malls are like, totally not dead, y'know?

That helps explain the stellar performance by the SPDR Dow Jones REIT ETF (RWR), which owns Simon as well as other mall stocks like General Growth Properties (GGP), Macerich (MAC) and Taubman Centers (TCO).

The ETF also has good exposure to apartment REITs like Equity Residential (EQR). The current economic conditions are great for apartment companies. More people have jobs than five years ago, but many are holding off on buying homes due to stagnant wages and tight credit.