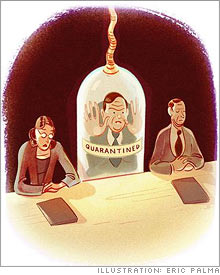

Catching the options virusDid options backdating spread through a few contagious directors?(Fortune Magazine) -- Here's what I couldn't understand about the options backdating scandal: How could behavior that in most cases is so clearly bad and wrong be happening at so many companies? There was only one Enron. And the slimiest late-1990s tactics of the investment banks and mutual fund firms existed mainly in a handful of companies. But at least 120 companies are under investigation for backdating, and the number rises weekly.

Now an intriguing new type of research suggests what was really happening among all those options backdaters - and holds a message for how to fix boards gone bad. The short answer to why this sketchy practice was so widespread is that the directors of these companies were talking to each other. Obvious, right? But look deeper and there's more to see. Scientists have been studying interactions in social networks - all kinds of groups from office workers to criminals - for more than 50 years. The Corporate Library, a research firm, had the inspired idea of applying these same study techniques to the boards of companies caught up in the backdating scandal. These companies share directors to a far greater extent than you would expect in a random sample of U.S. firms. The Corporate Library checked to see if they tended to use certain accounting firms or compensation consultants - possible suspects in this scandal - but found no patterns. It's true that many of the companies involved are in Silicon Valley, where belief in the motivating power of stock options is embedded in the culture. But people do the backdating, so human connections must hold the key to the broad extent of malfeasance. And as the research report states, "Director interlocking relationships are fast becoming what appear to be the most important characteristic and indicator of backdating problems." In other words, we can think of backdating as a communicable disease. Pinpointing the source Which prompts an irresistible question: By analyzing the director network, can we tell where the problem started? Can we name the Typhoid Mary of backdating? Not exactly, but researchers can diagram the network and identify the most central boards. The report says they are the boards of infotech manufacturer Sanmina-SCI (Charts), chipmaking-equipment supplier Novellus Systems (Charts) and Internet-equipment supplier Juniper Networks (Charts). Those companies disagree strongly. Novellus CEO Richard S. Hill tells me flatly, "We do not backdate stock options." The Corporate Library says it included the company because two shareholder lawsuits allege backdating, and if the suits are dismissed, Novellus will be removed from the research. Hill calls the study "amateur statistical epidemiology." A Juniper spokeswoman says only that the company disagrees with the study's methodology and conclusions. Sanmina-SCI declined to respond. In any case, isn't this purely guilt by association? Is there a shred of evidence that any specific individuals spread backdating? I asked the study's lead author, Paul Hodgson, who responds, "I'm careful not to say we have definitive proof that these directors spread the practice. We don't. But the theory of social networks, supported by mounds of academic research, suggests very strongly that directors were spreading the practice by word of mouth." Governance researchers aren't the only ones interested in directors' social networks. SEC enforcers are also on the trail. One of them tells me they're looking at many kinds of connections - directors, law firms, other service providers - to find more potential backdating violators. The larger lesson, too often forgotten, is that boards are human institutions above all. Through the past five years of scandals, reformers have pushed structural changes - separating the chairman's job from the CEO's, or mandating a lead director. But Corporate Library editor and co-founder Nell Minow says, "One thing I've learned over the past 20 years is that structural solutions don't get you even halfway there." Boards of the backdating companies had many different kinds of structures; that didn't matter. The answer is not to change the directors' titles, it's to change the directors. _______________________ |

|