Scandals rock Silicon Valley's top legal aceFrom Apple to Netscape to HP to YouTube, Larry Sonsini has been the most important lawyer in the most important industry for 30 years. But is he too close to the companies he represents? Fortune's Roger Parloff reports.(Fortune Magazine) -- "I first remember hearing Larry Sonsini's name probably in 1986 or 1987," says Dave Roux, who co-founded Silver Lake Partners, a private-equity firm in Menlo Park Calif., focusing on technology investments. Back then, when Roux lived on the East Coast, he was at a meeting of the board of Lotus Development in Boston, when someone suggested they find the "East Coast Larry Sonsini" to act as their lawyer.

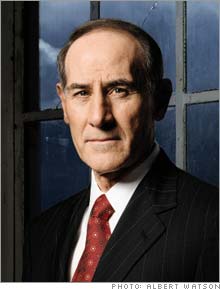

Larry Who? Roux asked. "They explained to me that he was the Larry Bird of Silicon Valley," he says. "The go-to guy when you need the thing to work. The ice-in-his-veins, blue-collar, scramble-for-the-ball, great-teammate, no-ego, championship-caliber guy." Twenty years later everybody in the tech business knows Sonsini. He is the most influential and well-connected lawyer in the industry. But he's more. Sonsini, 65, is an integral part of Silicon Valley's history and culture. He's the unflappable, low-key business advisor everyone trusts, which is saying a lot in a community of super-smart, hyperaggressive egomaniacs. He's the behind-the-scenes player to whom the executives at the most innovative companies of the Digital Age take all their toughest business problems. This year, though, Sonsini's 40th with the Palo Alto firm of Wilson Sonsini Goodrich & Rosati, he's found himself shoved uncomfortably into the spotlight. Some newspaper readers first learned his name in July, when it appeared in articles about the options-backdating scandal. Many of the implicated companies were tech firms, and a high percentage of them were his clients. In September his name came up again when he was called before a subcommittee of the U.S. House Energy and Commerce Committee to answer questions about Hewlett-Packard's now infamous board leak investigation. Rival lawyers and corporate-governance watchdogs then piled on, raising questions about whether Sonsini wore too many hats in the Valley, by investing in clients and serving on their boards. Maybe he represented so many clients, they argued, that he was risking conflicts of interest. There's no disputing that Sonsini's client roster is long. It could serve as an outline for a history of the digital revolution. He started out working for semiconductor companies like LSI Logic, Cypress Semiconductor and National Semiconductor, then moved on to hardware companies like Silicon Graphics, Apple Computer, Sun Microsystems and Seagate Technologies, then represented software firms like Novell, WordPerfect and Sybase, and finally added Internet pioneers like Netscape, Google and YouTube. This month Sonsini will complete another defining deal, the $17.6 billion acquisition of client Freescale Semiconductor (Charts) by private-equity investors - the largest tech buyout ever. This is the story of how a modest securities lawyer became the most powerful man in the most crucial sector of the American economy. And what it means when a player noted for his probity and unfailingly good judgment suddenly finds his name being linked to some pretty sleazy behavior. Driven At an interview in Sonsini's Palo Alto office in October, his discipline and organization are immediately apparent. Papers are arranged in neat, evenly spaced stacks across his desk. The desk is modest in size, with clean, modern lines - no frippery. He is dressed elegantly in a dark suit and tie, which stand out in Silicon Valley, where business casual was born and still flourishes. At five foot ten and 165 pounds, Sonsini is fit from morning workouts in his home gym. He weighs slightly less than he did in college. Sonsini speaks calmly in a confident, voice-of-God baritone that a network news anchor would covet. There is no irony, sarcasm or cynicism evident in him, and he seems guileless in comparison to many East Coast lawyers. His sentences end promptly as soon as he has answered a question, another uncommon trait in his bill-by-the-hour profession. He is more Gary Cooper than Cary Grant. What's concealed is what his partner Bob Latta refers to as the "nuclear reactor in his stomach," his drive to excel at anything he does. In 1984, when Latta was still a young associate, Sonsini invited him and another lawyer to fill out a foursome at the nearby Sharon Heights golf course. At the time, says Latta, Sonsini preferred tennis and wasn't much of a golfer. When Latta arrived, Sonsini and client Ken Oshman - the "O" in telecom-equipment maker ROLM Computer - were already banging balls on the driving range with strange intensity. Latta then discovered that Sonsini and Oshman had already played an 18-hole round that morning; he would be joining them for their second round of 18. Then Latta found out what was going on. "Oshman's company was being acquired by IBM," he explains, "and the IBM guys are serious golfers. So Oshman and Larry are going to get good at golf. Larry's not going to do something that he isn't going to be good at. They must have been out there for nine hours." Sonsini was born in Rome, N.Y. When he was 8, his father, a quality-control inspector at Revere Brass & Wire, packed up his family and moved. "Rome wasn't growing," says Sonsini, "and he had an itch." In Los Angeles, Sonsini' s father found work with Hughes Tool Co. and, though he had no college education, climbed through the ranks to the No. 2 position. "He instilled in me a very strong work ethic," says Sonsini. "It wasn't important what you did, but it was important that you do something and do it well." Despite his slight build, Sonsini became a quarterback in high school and then, as just a freshman at the University of California at Berkeley, a first-string varsity rugby player on a team in contention for the national title. Yet Sonsini gave up college athletics in his second year to focus on his studies. "I wanted to be a professional," he says, "and I wasn't going to be a professional athlete." Upon graduating in 1963, Sonsini entered Berkeley's Boalt Hall School of Law. During the spring of his first year, in 1964, tear gas periodically wafted over the campus from Sproul Hall, for this was the year of the Free Speech Movement - the opening bell of the 60s. But Sonsini was "a pure observer of it all," he says. "I was so consumed in law school." (Though several of his partners today are major political fundraisers - John Roos for Democrats and Boris Feldman for Republicans - Sonsini's own politics are largely unknown, even to his partners.) Finding a niche in Palo Alto Already determined to become a business lawyer, Sonsini signed on as a research assistant to professor Richard Jennings, a frosty don who had co-authored the first casebook on securities regulation. Though most Boalt graduates joined big commercial firms in New York, Los Angeles or San Francisco, Jennings suggested to Sonsini that he look at a tiny outfit in Palo Alto. "Dick said to me, "There's something going on down in the Valley. There are a lot of young businesses starting, and they're companies that are going to have to go public." At that time Santa Clara Valley was already home to a handful of mature tech companies, including Hewlett-Packard (Charts) and Fairchild Semiconductor. Hewlett-Packard - launched from a garage and dedicated to innovation - was serving as an inspiration and paradigm for many young entrepreneurs. Early venture capitalists were providing seed capital. Thanks to liberal intellectual-property policies, Stanford and Berkeley were letting their engineering graduates try to commercialize inventions they'd come up with while still in school. "It was still early," Sonsini says, "but you could see it. Something unique was happening." Though the starting pay was well below San Francisco rates - and notwithstanding that Sonsini had no savings and that his wife was pregnant with their first child - he rolled the dice with the firm then called McCloskey Wilson & Mosher, where he became the first associate. His new mentor was John Wilson, then 50, who after a distinguished legal career in the East had moved to the Valley in 1956. (Wilson died in 1999.) "So we started to develop the recipe for how to build companies," Sonsini recalls. The recipe required entrepreneurialism, capital and infrastructure, and Wilson's law firm was part of the infrastructure. "I was becoming a piece of the recipe," Sonsini says. "What I was learning very early on," he continues, "was that I could build an enterprise too. In fact, I had to." Wilson and Sonsini both wanted to continue to represent their clients as they grew, rather than handing them off to larger firms when they went public. To do that, they'd need additional expertise, and Sonsini was put in charge of figuring out which new specialists the firm needed, and then recruiting them. "So I guess I was thrown early on into a leadership role," he says. In 1973 his name went on the door, and in 1978 the firm, still with fewer than 15 lawyers, adopted its current name: Wilson Sonsini Goodrich & Rosati. Though the firm represented venture capitalists and investment bankers from time to time, its preference was to represent the startups themselves - a strategy not always understood by its younger lawyers. Latta remembers when he was an associate in the 1980s being in Sonsini's office one day when Sonsini took a call on the speakerphone from Bill Hambrecht and George Quist. Their firm was then the dominant high-technology underwriter in San Francisco, and they had called to inquire if Wilson Sonsini would agree to become their regular outside counsel. "I think I literally got out of the chair and started jumping up and down," Latta recalls. He was gleeful, he explains, because he thought that now he'd have a shot at making as much money as his classmates who'd gone to San Francisco firms. "But Larry doesn't hesitate for a second," Latta continues. "Immediately he takes this apologetic tone and starts talking about why that's not a good idea for them. That there are several law firms up in San Francisco that can do just a fine job of representing them, whereas there's really only one firm down in Palo Alto that can do a good job of representing the companies they want to back. 'Isn't my highest and best use for you to continue to do what I'm doing? And if, by the way, that means you introduce these companies to me if you get to them before I do, that would be appreciated.' It was just brilliant." Sonsini explains: "My view was that representing companies enables you to get involved at all stages of their growth. You develop a breadth and depth that makes you a better advisor and a better lawyer. It was also a fundamental part of the business plan. Many law firms at that point were focusing more on the capital markets side, representing investment banks, and to me that left a great opportunity to really develop the other side of the business." Investing creates conflict There was also one fringe benefit to representing the companies. Senior corporate lawyers at Valley firms sometimes got opportunities to invest in clients at the venture capital stage. Most startups would fail, but those that went public could pay off handsomely. Taking stakes in clients, however, created a potential for conflicts of interest. If a lawyer holds stock in a client company, for instance, and then has to decide whether the client needs to disclose information that will cause its stock price to plummet, the lawyer's judgment might be clouded. Such investing might also trigger internal rifts at a law firm, since only the corporate lawyers were likely to get the opportunities, leaving their partners in other specialties out of a lucrative loop. So in 1978 Wilson Sonsini set up WS Investments, a fund designed to manage both problems. Each partner's pay would automatically be docked to create the fund - the deductions were mandatory - and each would, in turn, have a stake in the proceeds. Small investments in private companies could then be made when opportunities arose - typically $25,000 to $50,000, according to Sonsini. (Still, the payouts could be big. The fund's investment in Google (Charts), for instance, was worth close to $20 million after the company's IPO in 2004.) This way, each partner's stake in the fate of any one client would be diluted and all partners got a piece of the action. "It's an opportunity for a return," Sonsini says of the fund. "And many times it's how we get paid. [Startups] don't have any money. So if I invest $25,000, you know what he does? Over a period of 12 months he pays us $25,000 back in the way of legal fees." In later years, investing in startup clients became a nearly universal practice among Silicon Valley law firms. Nevertheless, many East Coast lawyers and other critics condemn it because of the lingering potential for conflicts. "I don't buy the argument that the incentive with regard to any particular company is diluted, because so many issues - like backdating, expensing options, etc. - apply across the entire sector," says corporate-governance watchdog Nell Minow, co-founder of the Corporate Library research firm. Should Sonsini have flatly banned such investing? "During the days of building the Valley," he says, "when we were all working together as entrepreneurs and trying to build industries, I don't know if that would have been a good thing or not." The tech market explodes The event that marked Wilson Sonsini's arrival on the national business stage was its representation of Apple Computer (Charts) in its initial public offering in 1980. It was the largest IPO since Ford Motor Co.'s in 1956, and the notion that a local Palo Alto firm would handle it was a seismic event in the deal community. There was also a mini-bull market at the time, enabling the firm to rattle off a series of tech IPOs, and the momentum began to feed on itself. By 1988, Wilson Sonsini's average profits per partner reached $430,000, blowing past all the San Francisco firms and outpacing the nearest competitor by $100,000, according to The Recorder, a San Francisco legal newspaper. But it wasn't just reputation that was selling Sonsini. When you meet a few of his entrepreneur clients - intimidatingly smart, headstrong, combative, abrasive - it becomes apparent that these are not the easiest people to advise. Yet they all seemed willing to listen to Sonsini. "I don't take orders well," says T.J. Rodgers, the founder, chairman and CEO of Cypress Semiconductor. "But taking advice from Larry Sonsini is easy. He's professorial. He's nonjudgmental. 'You can choose to do this, you can choose to do that, and these will be the consequences.' So you realize you're not being forced or pushed into anything. He explains to us why the sometimes frustrating, arcane and inefficient system we have makes sense, or at least made sense at one time, and therefore should be followed." These entrepreneurs were so eager to use him that they did not seem to mind that he often also represented their competitors. For a period in the 1980s, Sonsini was representing Seagate Technologies, Conner Peripherals and Quantum, which were then the country's three largest disk-drive companies - and bitter enemies. "It's a tradeoff," says Steve Luczo, Seagate's chairman and former CEO. "Because he's counsel to the three biggest, he's also most aware of the issues that face the industry. That's what you want." In addition, Luczo says, he trusted Sonsini to keep his confidences. "We're not idiots," he says. "Would you do that all the time? No. With Larry? Yeah." That reasoning may make more sense in Palo Alto than in New York City, since the Valley lawyering style is less adversarial. "Most East Coast lawyers are in the business of protecting wealth," explains Latta. "You're talking about a pie that's not changing size much. You've got to take share away from someone else, and one way you compete is with your lawyer. Lawyers are combatants. Out here it's always been different. Larry's always been in the business of creating wealth. We don't want to spend weeks arguing, with lots of theatrics." A lot of wealth was definitely being created. Netscape's 1995 IPO ushered in a new phase in the Valley's history by demonstrating that even a company with no earnings history could go public and make its investors fabulously wealthy. The bubble happened fast, and Sonsini hadn't seen it coming. "Things started to align, and it just exploded," he says. "We handled 2,000 private companies, and now this great window opened up for them, and you can imagine what it was like." Wilson Sonsini did 118 initial public offerings in 1999 (representing both companies and underwriters) - the most of any law firm in the nation. The firm bulked up to handle the workload, peaking in size at close to 800 lawyers in 2000. Other firms were belatedly arriving on the scene too, of course. While Wilson Sonsini had competed mainly with two other Valley firms in the 1970s, by "tulip time" more than 40 major national law firms had opened outposts there. "That was a period of raw greed," says Boris Feldman, the head of Wilson Sonsini's litigation department. "Greed was always an important component in the Valley, but it was sort of restrained greed: the sense that if you build a good company, you'll be rewarded for it. But during that time framework, what people forgot was the element of building value. It was much more like a gold rush. The values in the Valley were, if not corrupted, then certainly strained." In 1999 and 2000, Sonsini says, it became "somewhat of a practice" in the Valley for lawyers to insist on being given investment opportunities in their startup clients as a condition of representing them. He admits that some Wilson Sonsini lawyers did this, and that they shouldn't have. It was widely reported that many Silicon Valley lawyers were making more off their investments in clients than from their legal work. According to The American Lawyer magazine, WS Investments distributed $175 million to the firm's members in 2000. The figure plummeted to $8 million a year later. A Wilson Sonsini spokesperson says she doesn't know where the $175 million figure came from, that it sounds wrong, and that it would be hard to compute a meaningful substitute. Sonsini maintains that only very junior partners at Wilson Sonsini - those with salaries then in the $400,000 range - would have ever made more from WS Investments than from their partnership draws. (Wilson Sonsini's average profits per partner from legal work in 2000 were $835,000, according to The American Lawyer.) After the crash, Wilson Sonsini's lawyer ranks dropped to fewer than 600 before they began growing again. Excess baggage In 2001, Sonsini achieved another landmark validation of business stature, not unlike the Apple IPO in its symbolism. This one, however, brought some baggage with it. "Dick Grasso, then chairman of the New York Stock Exchange, came to me and said, 'We don't have anybody from the West Coast, and we don't have anybody from the technology industry, and I would like to propose you to become a board member of the New York Stock Exchange,' " Sonsini recalls. Sonsini joined in February 2001. Minow's Corporate Library now labels Sonsini a "problem director" because he sat on that board during part of the time when Grasso was amassing his now infamous $189 million deferred-compensation package. The NYSE board, though, had 27 members at the time, Sonsini was not on the compensation committee, and former U.S. Attorney Dan Webb's official postmortem of the debacle concluded that the directors who weren't on that committee were misled. (Sonsini declines to discuss the issue, citing pending litigation.) Sonsini's winning Hewlett-Packard as a client was another landmark, and another mixed blessing. As a young lawyer in the 1970s Sonsini's ambition had always been to one day represent Hewlett-Packard, the template for all the Valley startups that followed. In the late-1990s Sonsini got his wish, eventually handling Hewlett-Packard's $2.2 billion spinoff of Agilent Technologies in 2000 and its $19 billion merger with Compaq Computer in 2001. Then came "pretexting." From early 2005 to March 2006, Hewlett-Packard's nonexecutive chairwoman, Patricia Dunn, led two internal probes to find out which board member was leaking information to the press. The company's investigators deceived phone companies into providing them with private phone records of directors and journalists - an activity that ultimately led to felony charges against Dunn, then senior HP lawyer Kevin Hunsaker and three investigators. Sonsini has faced a wave of criticism arising from the affair, culminating with his being summoned, along with Dunn and HP CEO Mark Hurd, before a House subcommittee in late September. It turned out, however, that the most serious criticisms against him were based on false assumptions. As the story of the ham-fisted operation became public in September, internal HP documents leaked out that indicated that an outside law firm had approved the pretexting operation in advance. One had, but it wasn't Wilson Sonsini, as many initially assumed. It was, rather, a tiny firm in Massachusetts that did work for - and shared space with - one of the now criminally charged investigators. The voluminous documents made public by the House subcommittee establish that Wilson Sonsini was never consulted about either probe until April 2006, after the snooping had been completed. At that point Dunn asked not for a legal opinion about the methods used - which HP described to Sonsini in a memo only as "lawful methodology" used by "licensed security firms" - but for advice about what to do about the leaker. Still, it looked bad when a Sonsini e-mail surfaced that concluded: "It appears, therefore, that the process was well done and within legal limits." The e-mail was part of an exchange in June with venture capitalist and former HP director Tom Perkins, a co-founder of Kleiner Perkins Caufield & Byers. By that time Perkins had found out that his private phone records had been obtained. Perkins also then believed, incorrectly as it turned out, that there might have been wiretapping too. Yet the context of the e-mail was not appreciated. Sonsini had still not been asked or authorized by HP to conduct any additional investigation. He was told simply to relate to Perkins what had been done and the opinion of the HP in-house lawyers about its legality. In his e-mail to Perkins he did so, explaining in the first paragraph that his information came from Hunsaker and Baskins. Only later, in August, did HP finally retain Wilson Sonsini to look into what the investigators had done and independently assess its legality. After doing so, the firm concluded that while "pretexting at the time... was not generally unlawful," it became unlawful when conducted in certain ways and that, accordingly, the firm "could not confirm that the techniques & complied in all respects with applicable law." The recommendation was that "HP immediately cease pretexting." Tom Perkins won't comment on the HP matter, but he says this about Sonsini: "He's very ethical, brilliant, successful. People are taking shots at him. In my book, he's still No. 1. Expect him to continue to work with all of [Kleiner Perkins's] companies." Questions of independence Then there's the options-backdating scandal. That kicked off in March 2006, when a Wall Street Journal article showed that many stock option grants during the late 1990s and early 2000s had been exquisitely well timed, suggesting that their grant dates must have actually been chosen retrospectively - i.e., backdated. As a result, the Securities and Exchange Commission launched an inquiry. Options were a particularly important form of compensation for startup technology companies and a central pillar of Valley culture. They were routinely given not just to directors and top officers, but also to members of the rank and file. Of the 120 companies now being scrutinized for backdating, either by government officials or internal auditors, 42 are Silicon Valley companies (35 percent), and of that subset, at least 40 percent were Wilson Sonsini clients during the relevant period. These numbers look ominous, but for two reasons may not be. First, Wilson Sonsini's clients are no more heavily represented among the companies under scrutiny than those of any other law firm, once you take into account the firms' relevant market shares and niches. The premier East Coast technology firm, Boston's Hale & Dorr - now WilmerHale - represented five of the 13 Massachusetts-based companies on the list of accused backdaters, or 37 percent. Similarly, six of Wilson Sonsini's leading Bay Area competitors represented multiple Silicon Valley clients on the list, seemingly in rough proportion to their shares of Valley business. The second reason, according to nine Silicon Valley public company board members, CEOs or outside lawyers, is this: While outside law firms may be involved in drawing up a stock options plan for a public company, they very rarely administer it. And that's where all the problems have been showing up so far: missing documentation, misdated or forged records, faulty accounting. "I've never seen it done by outside counsel," says tech investor Roux, of Silver Lake Partners, who has served on many boards and compensation committees. "How to give options is well known," says Rodgers, the Cypress CEO. "You hire outside counsel, they have their word processor kick up a bunch of documents, and they charge you 50,000 bucks. Then you and your HR person give out options according to the plan. You administer it; they're not involved. You don't want them involved, because you don't want to be sent a bill for $2,000 every time you give out stock options." Sonsini's more direct link to the backdating scandal is through his board ties: He was a director at two companies that have encountered options problems. One was Brocade Communications (Charts), whose former CEO Greg Reyes and former human resources chief have both been charged with criminal backdating violations by federal prosecutors in San Francisco. Though the prosecutors theorize that Reyes defrauded the company's board of directors, Sonsini has been tainted by the association. Because Sonsini was on Brocade's audit committee one year, he has also been named as a defendant in private class-action suits. Sonsini was on the board of Novell (Charts) too, which has initiated a voluntary audit of its options practices. Like all Novell directors, Sonsini received options himself. He never exercised his, according to a firm spokesperson, and they expired three months after he left the board in 2002. Sonsini declines to discuss either Novell or Brocade. What has been offered as the smoking gun implicating Sonsini in the scandal is that he allegedly recommended that Brocade's board make Reyes a "committee of one," with power to grant options without the full board's approval. That's what Reyes himself told Business Week in February. In an interview with Fortune, Reyes' s criminal defense lawyer, Richard Marmaro, seems to implicate Sonsini via gushing praise: "Sonsini at all times acted totally above board and with the highest ethics of the profession, and my client relied on his sage advice." A Wilson Sonsini spokeswoman says that Brocade's committee of one was actually set up by a different law firm, which she declines to name. In any event, committee-of-one arrangements are neither as rare nor as intrinsically reckless as they may appear. The "committee" at Brocade could award options only to rank-and-file employees, not to officers and directors, so there was no opportunity for self-dealing. In that context, the practice was - and remains - pervasive, since it's not practical to have full boards constantly approving options grants to scores of employees. "If you're moving quickly in a hot job market," says former SEC commissioner Joseph Grundfest, who co-heads Stanford's Rock Center for Corporate Governance, "and there's an employee you want, boards would delegate to CEOs the authority to make offers for grants up to a certain size or for a certain total number of shares. That would not be rare in the least. And creating a committee of one never gave anyone the right to backdate. That said, in hindsight it clearly would be better practice to have crisper controls on that process, particularly to make sure that grant dates are appropriately and timely documented." The remaining thing Sonsini might be faulted for is sitting on the boards of his clients. That's another practice that's more common on the West Coast than in the East, and one that some corporate-governance watchdogs denounce. "The duties of a lawyer and a board member are fundamentally different," says Minow, of the Corporate Library. "You can't be the third base coach, the umpire and the batter at the same time." Here the watchdogs appear to have won their argument. Though Sonsini sat on nine public boards in February 2002, today he's down to just one, and he says he expects to phase out that one soon too. He's come around to the view that "the presumption" should be against sitting on public boards. "It' s a question of the evolution of independence and objectivity in corporate governance," he says. Last year Sonsini considered retiring from law practice to become chairman of the private-equity firm Silver Lake Partners. But having turned down the offer, he says he plans to continue practicing for the foreseeable future. (His father, a vigorous 90, participated in the firm's celebration of Sonsini's 40th year of practice at a retreat in Pebble Beach this year.) "I have so many friends who say, 'Look, why aren't you stopping? We can all go take golf trips,' " he says. "That's the last thing I'm made of. I'm just beginning to be the best lawyer I can be, and why would I get off the train now? If you're going to be a top business lawyer in this country, you've got to take a lot of years. You don't develop the judgment except over a long period of time." Evidently you develop some thick skin too. _________________ From the November 27, 2006 issue

|

|