India's billion-dollar buyoutsIndia's steel giant Tata bought out Britain's Corus Steel for $12 billion. Now other Indian companies are following suit, says Fortune's John Elliot.(Fortune Magazine) -- Watch out for more big takeover bids from India's increasingly confident companies after Tata Steel's $12.1 billion victory in its battle with CSN of Brazil for control of Corus (Charts), the British steel company. The merger will create the world's fifth-largest steel company and make the diversified Tata Group the largest in India, far outstripping its rival, Reliance Industries.

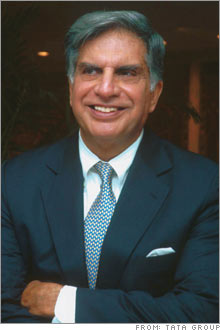

Two bids with pricetags in excess of $5 billion are already in the offing, though it is too early to know whether the Indian firms involved will prevail. Pharmaceuticals company Ranbaxy has confirmed that it is interested in buying the generics arm of Merck (Charts) in the U.S., and the Aditya Birla Group is said to be eyeing Novelis (Charts), a Canadian aluminum company that has reported it is in talks about a possible sale. Those sums mark a gigantic step forward from past takeover deals, all of which were for less than $1 billion. The Tata Group has been in the vanguard of outbound investment in recent years, spending $677 million for a 30 percent stake in Energy Brands, a U.S. bottled-water company, and $890 million for two steel companies in Thailand and Singapore. But other companies, such as ONGC, a government-owned oil and gas giant that has invested $3 billion since 2002 in projects in Russia, Sudan and elsewhere, have also been active. "The surge of foreign investments is already underway," says Chanda Kochhar, deputy managing director in charge of international and corporate banking at ICICI, a leading Indian bank. ICICI estimates that India's foreign takeovers last year totaled $8.5 billion, double the 2005 figure. That trend will likely be boosted by a Standard & Poor's decision in late January to restore India to full investment-grade status after a 15-year lapse, making it easier for Indian companies to raise funds abroad. Says Finance Minister Palaniappan Chidambaram: "Indian industry today has the confidence to bid for business abroad, raise resources, purchase and manage enterprises." Ratan Tata, chairman of the Tata Group, called the Corus deal a "moment of fulfillment for India" and a "visionary move." But the stock market, perhaps because it thought the deal price too rich, didn't agree: Tata Steel's share price fell 11 percent the day the deal was announced. From the February 19, 2007 issue

|

Sponsors

|