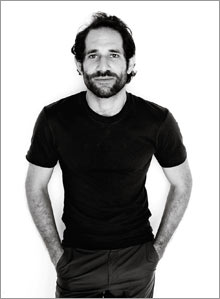

The IPO gets edgyWhat's trendy on Wall Street? Shell "companies" that go public with no business plan other than to buy an existing brand with shareholders' money, says Fortune's Jennifer Reingold.(Fortune Magazine) -- Dov Charney, CEO and founder of American Apparel, has never been much of a traditionalist. He produces his casual clothes in the U.S. when virtually all his competitors offshore them. His ad campaigns look more like nudie mags than the Neiman Marcus catalog. So it should come as no surprise that Charney has managed to take his company public using an edgy technique that, like some of his ideas, is fast becoming trendy. On Dec. 18, 2006, Charney said he was selling American Apparel to an already-public company called Endeavor Acquisition (Charts) for $384.5 million in restricted stock, cash and debt. Endeavor is a SPAC, or special purpose acquisition company - an entity that has gone public for the sole purpose of buying another company in the future.

According to Dealogic, 87 SPACs have begun trading in the U.S. since the end of 2003, buying some well-known companies like smoothie purveyor Jamba Juice. Last year alone, 40 SPACs worth $3.4 billion were announced, up from $484 million two years earlier. SPACs are essentially shell companies. They go public with little more to show investors than a management team and an agreement that the money raised will be used to fund an acquisition in a particular sector, such as retail, or in an emerging market like China. Ergo, a SPAC is a roll of the dice. "Imagine paying $50 to go to a Broadway show, and you have no idea what's behind the curtain," says lawyer Mitchell Littman of Littman Krooks LLP, who works with a lot of SPACs. "You are relying on the fortune and integrity of the management team." Once a deal is completed, the SPAC's managers (who typically receive 20 percent of the public shares as compensation) are free to sell their holdings, usually after a lockup period. Today's SPAC boom harkens back to the flurry of "blank check" companies that sprang up in the 1980s. Those were widely discredited by a wave of scams in which fraudsters would take a shell company public, announce a merger, pump the stock and then dump it before everyone realized that the hot target company was anything but. Investors have a lot more protection with SPACs, which must hold almost all the money in escrow until a deal is done. From Charney's perspective, there is no downside to the arrangement. It lets him raise cash relatively quickly, remain the largest shareholder and avoid having to sell other investors on his vision until after his company is already publicly traded. "I'm in a hurry to get the money," he says, citing his plan to expand beyond his current 145 stores. "What's great about the SPAC is, it's kind of in reverse. First you get publicly traded, then you do the compliance stuff. And if you brought in private equity, they might want to run the company in a more [cautious] manner," he says, referring to American Apparel's risqu� image. Keeping control is particularly important for a guy who is the creative force behind the brand, as well as one whose flamboyant management style - there is one sexual-harassment suit outstanding against him by a former employee; two others have been dismissed - might scare off many investors. "He is very talented," says former J.C. Penney CEO Allen Questrom, a partner in private-equity firm Lee Equity Partners, "but he is a meshugana [read: nutty] type guy. It's very difficult to see him in a public sphere." (Charney, for his part, dismisses the talk about his reputation as "all tabloid.") Charney's new bedfellows don't appear concerned, even if they're more likely to wear dark suits than American Apparel's colorful leggings. Endeavor's president, Jonathan Ledecky, is familiar with unusual financing vehicles; he founded U.S. Office Products, the once-hot roll-up that went bankrupt in 2001 (long after Ledecky cashed out). Boldfaced names on the board include Kerry Kennedy, Bobby's daughter, and Edward Mathias, a managing director at the Carlyle Group. On Jan. 31 the same group formed a new $250 million SPAC, Victory Acquisition, underwritten by Citi. The filing notes that it could compete directly with Endeavor. And as with Endeavor, once Victory goes public it will pay a Ledecky "affiliate" $7,500 monthly to run its Manhattan office. Hedge funds are drawn to these investments. Since SPACs typically must announce a deal within 18 months of their IPOs or return the money raised, with interest, hedgies see them as safe places to park cash while potentially profiting from the price fluctuations between a deal's announcement and its close - a sort of arbitrage play. That may be why Steven Cohen's $12 billion hedge fund SAC Capital snapped up 8.7 percent of Endeavor's stock when the deal was announced. Even if investors are SPAC-happy, not all regulators are: So far only the American Stock Exchange lists SPACs, and many bankers and lawyers say the SEC is deliberately taking its time vetting deals, hoping to slow down the pace of offerings. SPACs are probably best left to those, like Charney, who like to live life on the edge. ________________ From the February 19, 2007 issue

|

Sponsors

|