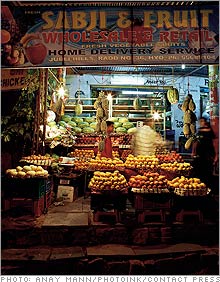

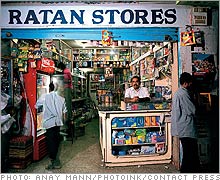

India's retail revolutionWill India's mom-and-pop stores perish with the arrival of modern supermarkets? Fortune's John Elliott reports.(Fortune Magazine) -- Suresh Prasad sells groceries from a 12-by eight-foot store opposite a new Reliance Fresh supermarket in the southern Indian city of Hyderabad. His specialties are 10-cent pastry puffs and cakes. With the supermarket drawing new customers to the area, his sales have doubled. Venu Gopal owns a slightly larger store opposite another supermarket a few kilometers away. Sitting on a stool behind a glass counter topped with plastic bottles of sweets and surrounded by closely packed shelves of rice, lentils, fruit juices and other groceries, he sells two or three sweets to children, a single cigarette to another customer, and tiny tobacco sachets every few minutes. "Our customers," he says, "come for small quantities."

Those are hardly the dire scenarios of doom forecast by opponents of India's retailing revolution, who have taken to the streets to defend the livelihoods of more than 12 million mom-and-pop shop owners. In May and June hundreds of demonstrators armed with stones and bamboo sticks sacked Reliance stores in three cities, including Delhi. In Kolkata merchants marched to protest a Reliance contract to redevelop their market. But in Hyderabad, the epicenter of the revolution, where Reliance Fresh has opened 50 brightly lit, Western-style stores in the past seven months as the front edge of a nationwide rollout, the reaction has been more muted. And the evidence seems to suggest there's room for everyone - street sellers and mom-and-pop shops, known as kiranas, as well as large chains. "Definitely there is room for both," says Doma Trivedi, a franchisee of one of Reliance's most successful supermarkets in Hyderabad, whose wife and brothers continue to run the family's kirana a few kilometers away. "Everyone will have his own business. Smaller shops give credit and cater to people shopping on their way home from work, while Reliance Fresh gives correct measured weights and guaranteed prices." Reliance Industries, the parent of Reliance Fresh, along with other retailers, including Wal-Mart (Charts, Fortune 500), which has teamed up with Bharti Enterprises, wants to change the way Indians have shopped for generations. So far 220 Reliance supermarkets have opened in 20 Indian cities since the rollout began last November. Plans call for 2,500 outlets in the next four years, including 500 hypermarkets. The retailers' plans are generating opposition from wholesalers, other middlemen, and leftist political parties, which estimate that small-scale retailing provides livelihoods to about 20 million urban workers and 12 million rural vendors. To stem such opposition, Reliance has been opening bulk-buy stores called Ranger Farms in the early-morning hours that allow street vendors to buy at wholesale prices from the Reliance supply chain, thereby increasing their margins. That hasn't stopped the Communist Party of India (Marxist), which initially focused on blocking foreign investment in the retail sector, from calling for restrictions on the number and size of large stores that can be opened in a single locality. They also want protection for farmers who sell to large retail chains and will, they fear, be bullied into accepting low prices. Reliance and Bharti argue that their supply chains will replace corrupt officials and middlemen who run the current purchasing and distribution system, and reduce waste of up to 40 percent of produce sent to urban areas. A look at the potential impact shows many of the opposition's fears to be exaggerated. "India is at the beginning of a process of change, and customers are looking for something more modern, but there is no risk of serious unrest or job losses because only a limited number of small vendors will be affected," says Arvind Singhal, chairman of Technopak, a retail consultancy in New Delhi. He says that small players will be hit but that the impact will be limited to areas near supermarkets. By his estimate, 6,000 to 8,000 supermarkets will open across India in the next five to seven years, and each might draw customers from 20 to 25 kiranas and fruit and vegetable stands, affecting at most 150,000 vendors. This, he points out, is a small fraction of the total, and many will switch to selling increasingly popular products such as mobile phones or toiletries, or rent out or sell their premises. Set that alongside Technopak growth forecasts - that $330 billion in sales will reach $900 billion by 2015, of which modern retailing will account for 27 percent, with numbers employed rising from 40 million to 62 million - and it is clear that market expansion should more than compensate for the impact of new stores. But for vulnerable small traders operating on the margin, these forecasts are of little help today. In New Delhi, where supermarkets are opening fast, pavement and pushcart vendors are bitter. "I've lost half my business," says Rajiv Das, who has been selling fruit and vegetables for 18 years and now has to contend with a new Reliance store a three-minute walk away. "I'm not able to fight, but I would if I could." Similarly, Selva Kumar, who runs a kirana 100 meters from a Reliance outlet in Chennai, says, "We have lost 40 percent of our business, and that's the future. We're not closing, but there'll be no growth." There is less opposition in Hyderabad, India's most developed and sophisticated retail market, where the first supermarket opened ten years ago. The city of seven million is booming, with new shopping malls, luxury-car showrooms and construction sites. At Reliance Fresh stores, wide choices of produce are neatly arranged on shelves and in big display baskets. There are ten varieties of mangoes and 14 kinds of apples, some on sale. Signs hang from the ceiling, and smartly uniformed staff in red T-shirts add to the mood of efficiency. More residents of Hyderabad have traveled abroad than those from most other Indian cities, and they are "highly value-conscious," says Venugopal Komanduri, who runs Reliance Retail in Andhra Pradesh, where Hyderabad is the capital. That helps explain why modern stores - there are at least nine supermarket chains - already account for more than 20 percent of Hyderabad's retail sales, compared with only 3.6 percent nationally, according to a retail audit last year by Nielsen Co. But it's not all smooth sailing. Reliance has found its "fresh" tag hard to justify as summer temperatures have risen above 40 degrees Celsius. On a recent tour of several Hyderabad stores, papayas were found to be rotting, and other produce, such as cauliflower and bananas, looked grubby and tired. Staff said it was a "bad day," partly because it was "Sunday produce being sold on a Monday" and the power supply had been a problem. Yet the same poor quality was evident during later spot checks in Delhi and Chennai. "Our weather is playing havoc with the produce," Komanduri says. Not surprisingly, Komanduri calls this a "learning curve." India has few refrigerated warehouses, and no retailer has tried to develop countrywide supply chains for fresh produce, linking collection points in rural areas to processing depots near urban centers. Reliance Fresh has been trying - and failing - to cope with 175 varieties of fruit and vegetables at the height of summer (down from 243 in winter). Customers have noticed. "It's good value here, better than other supermarkets, but there are difficulties with the quality, especially apples and papayas," says Rama Tibrewal, a middle-aged Reliance shopper in Hyderabad. Other customers agree. "The quality is not so good," says Ratana Shobha. It would seem that Reliance will be able to eat into small retailers' business in big ways only when quality improves and its stock widens to include household items, which is now happening across all its stores. The future rapid growth of the retail sector, together with shoppers' preferences in developed markets around the world for both big and small outlets, should mean that the impact on the mom-and-pops will be far less than feared. From the July 9, 2007 issue

|

Sponsors

| ||||||||||||||||