The greatest economic boom everA lot could go wrong. And it may not feel like a day at the beach to most Americans. But for your average globetrotting Fortune 500 CEO, right now is about as good as it gets, says Fortune's Rik Kirkland.(Fortune Magazine) -- Just how red-hot is the current worldwide expansion? "This is far and away the strongest global economy I've seen in my business lifetime," U.S. Treasury Secretary Hank Paulson declared on a recent visit to Fortune's offices. That may come as news to many Americans, whose boom-time memories are stuck in the 1990s, when Silicon Valley was the epicenter of our growth fantasies. But the fellow now occupying Paulson's old office at 85 Broad Street in downtown Manhattan shares that upbeat view. Just returned from a ribbon-cutting ceremony in the Middle East, Goldman Sachs (Charts, Fortune 500) CEO Lloyd Blankfein waves out toward the East River as he explains how the rise of the "BRICs" has altered his strategy and his travel schedule. (BRIC is an acronym Goldman coined in 2001 reflecting the rising economic power of Brazil, Russia, India, and China.)

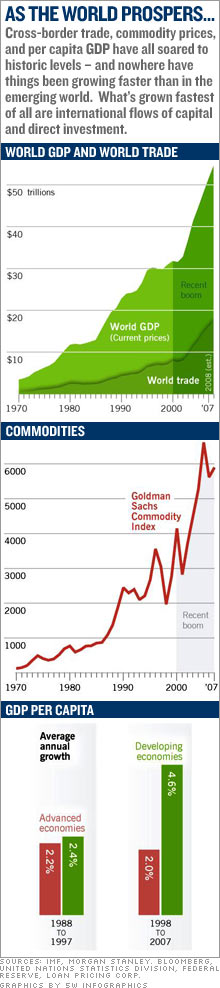

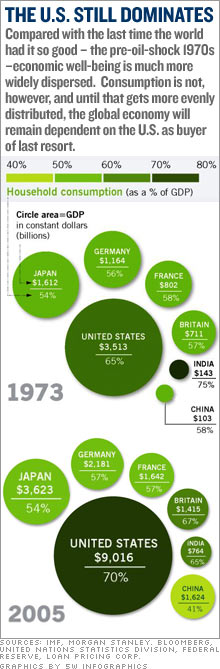

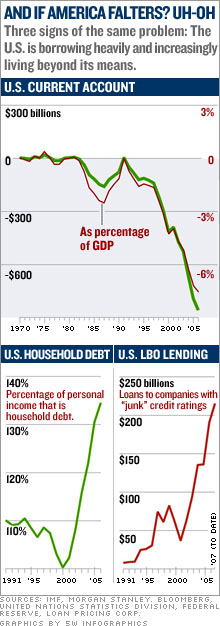

"I helped make my career by being very disciplined about opening offices," he says. Yet in nine months Blankfein has announced or opened offices in São Paulo, Moscow, Tel Aviv, Mumbai, Qatar, and now Dubai. "We've never done anything close to that before," he marvels. "The week before Dubai, I was in Turkey, and before that, Russia and China. I'm really living the BRICs-plus-Middle East kind of life." These days more and more CEOs are livin' la vida BRIC. GE's (Charts, Fortune 500) Jeff Immelt devotes 12 weeks a year to foreign travel and is looking for his company to grow "twice as fast outside the U.S. as inside - 12% a year, vs. 6%." Immelt expects to see even more robust growth - 20% a year - in emerging markets, which last year accounted for $30 billion of GE's nearly $170 billion in sales. John Chambers, who last fall opened Cisco's (Charts, Fortune 500) new Globalization Center in Bangalore, seconds the notion that "this is the strongest global trend" of his career. "There is a unique balance today," he says. "More than half of GDP growth is coming from emerging countries. And yet the developed countries are also doing pretty well. It is something we have never seen before." At Boeing (Charts, Fortune 500), Jim McNerney and his team, just back from the Paris Air Show, have booked 634 firm orders for their new 787 jet, which they will unveil in Seattle on 7/8/07 (ah, marketing!). That's more than for any launch in industry history, and thanks go "predominantly to Asian and other emerging-market buyers," says Laurette Koellner, president of Boeing International. While the current pace isn't quite a record - according to the IMF the world grew at a 5.4% average annual rate from 1970 to 1973, vs. a projected 4.9% from 2003 through 2007- there's really no contest. When our ties were fatter and we were thinner, total world GDP was $13 trillion in constant dollars. Today it's more than $36 trillion. Not to mention, as investor Jim Rogers notes, "there are three billion people in places like Eastern Europe, Russia, India, China, and all of Asia who weren't participating last time around but who now are." Back then, Germany and Japan led the charge. Now the emerging markets are running fastest, along with Europe, which has - for the first time in years - pulled ahead of the U.S. in GDP growth. The last global good time in the 1970s, of course, ended in a nasty bout of double-digit inflation, spawning the worst stock market crash since the Great Depression, plus other horrors, such as the rise of disco. Is that sorry past our future? Not necessarily. But with nervousness rising over everything from Bear Stearns' battered hedge funds to tightening lending standards that could clog the crowded private-equity deal pipeline, let us first explain how one can be, as we are, short-term bearish but long-run bullish on the global growth story. When it comes to markets, we hold these truths to be self-evident: (1) It's never different this time, and (2) Every boom leads to financial excesses that spark its undoing. (That's why they're called business cycles.) "The necessary conditions for a bubble to form are quite simple and number only two," investor Jeremy Grantham noted in a recent newsletter headlined "The First Truly Global Bubble." "First, the fundamental economic conditions must look at least excellent - and near perfect is better. Second, liquidity must be generous in quantity and price: It must be easy and cheap to leverage." That pretty much sums up the world we've been living in, a world where prices skyrocketed for Miami condos, Indian stocks, and office towers in Dubai. Now, though, with interest rates going up, heavily leveraged hedge funds and private-equity firms - not to mention cash-short adjustable-mortgage holders and the bankers who've lent to all three groups - have trillions of reasons to worry. Wilbur Ross, who earned a fortune correctly timing the distressed debt market, is among those who see a "real risk" of a credit shock. The subprime meltdown in the U.S., Ross believes, "isn't remotely over." "More important," he adds, "the same lack of discipline in extending credit has very much become prevalent in the corporate market as well." Since liquidity is more about crowd psychology than the actual money, a financial implosion could spook lenders, cutting off the easy financing that has fueled the record M&A and LBO booms and helped lift stocks to new heights. (That's why they're called credit crunches.) Then there's the really scary stuff: the prospect of a conflict in the Middle East that spills into full-blown war, an act of nuclear terrorism, and the like. Such "exogenous shocks," in the clinical argot of economists, would likely cause far more lasting damage than any mere market correction. In that sense "globalization remains a delicate phenomenon," says historian Niall Ferguson, whose writings offer vivid reminders of how the chaos of world war ended the first great round of this process early in the last century - and could do so again. Still, as long as some big geopolitical turmoil doesn't break out - and we're talking Ferguson-level large and bloody, as in August 1914, not October 1973 - the world economy should continue to benefit from globalization. Cross-border trade has soared since the early 1970s to record levels of world GDP. Cross-border financial flows have grown even faster, at a nearly 11% compound annual growth rate since 1990, according to McKinsey & Co. (Disclosure: I do occasional projects for McKinsey.) Much of that investment has generated strong returns, judging by one key measure: Since 1998, GDP per capita in the developing world has risen 4.5% a year, twice the rate of the advanced economies. The bottom line: If you look past the market's cyclical gyrations, deep secular shifts in technology, productivity, and patterns of consumption do, indeed, "change everything" - or at least change a lot of things. Consider Cisco. Anyone who bought its stock, now at $28, near the $80 peak seven years ago is still hurting. (And if you bought it on margin, God bless you.) But though the bursting of the tech bubble vaporized trillions of dollars of wealth, the revolution marched on. Today over 500 million households are connected to the Internet, more than double the number in 2000 - and half live in the emerging world. Cisco itself now enjoys sales of nearly $30 billion (up from some $19 billion in fiscal 2000), and profits have more than doubled. The long view matters. Which is why, having made billions by betting that rising emerging-world demand would spur consolidation in the long-moribund steel industry, Wilbur Ross is now trying to ride a similar trend in auto parts. Since August 2004 he has built up a $5-billion-a-year parts supplier from scratch, mostly by acquiring companies overseas on the cheap - "without adding debt," he hastens to add. It's why real estate billionaire Sam Zell, no dewy-eyed optimist but a tough, successful bargain hunter with a bad-ass nickname ("Gravedancer"), even ventures to suggest how things really are different this time. During the 1970s oil producers squandered their newfound gains by making government bank loans to "countries incapable of using it," he says. "Now it's mostly going into rainy-day funds or into productive private investments in places like China and India. That's a whole different kettle of fish from what we dealt with in the past." And it's why the transformations we've witnessed during this go-go beginning to the 21st century are mere prologue. *** "We want to go global by going East, not West," says Mohamed Ali Alabbar, the dynamic chairman of Emaar Properties, onstage at the Madinat Jumeirah resort in Dubai. The crowd in the cavernous room divides sartorially between business-suits-and-ties and white-robes-with-burnooses. Outside, motorized dhows ply canals lined with gleaming luxury hotels and shops. Up and down the main road hundreds of cranes twist under the desert sun, as builders race to erect more skyscrapers more quickly than anyplace on earth - among them Emaar's own Burj Dubai, which, when completed next year, will claim the title of world's tallest building. But this morning Ali Alabbar is talking mainly about the scores of malls and housing developments he plans to build in India and North Africa. "The West has got aging populations and aging economies," he says. "The East is where the true glamour lies." Ouch. Still, the man has a point. As the action moves to emerging economies, think of what's playing out as a global version of America's postwar boom. To catch up, these large populations first require commodities and basic building materials - witness the threefold-plus increase in prices of steel, oil, and copper since 2000. Then, as incomes rise, they spur vast new markets for everything from detergents to cellphones, from airports to hospitals. The McKinsey Global Institute forecasts that over the next decade nearly 450 million newcomers will join the middle class in China and India alone. Sam Zell is a believer: "I think this consumption story is kicking in on a worldwide basis." To get his share he bought big stakes in two public homebuilding companies in Brazil and Mexico and in the last year has begun investing in new low-cost housing in China and Egypt. At the same time, growing economies give rise to a new crowd of competitors and entrepreneurs. Think Brazilian jetmaker Embraer or Chinese PC maker Lenovo or Indian expatriate Lakshmi Mittal, who has built a steel colossus with some 10% of global market share. Surely it's early days for this trend, you say? "I hope it's early days," counters Goldman's Blankfein, "because we're investing now from the point of view that this has crossed a tipping point. You ignore the emergence of these new entrepreneurs at the peril not just of losing share in a local market, but of threatening your global franchise." Jeff Immelt isn't making that mistake. Last fall he took a list created by Boston Consulting Group of the 100 most important companies in developing economies and arrayed it into four camps: customers, suppliers, competitors, and nonaligned. "I tell my leadership team, 'Our goal for this group is to have lots of customers, lots of suppliers - and no competitors,'" he says. To stay ahead, Immelt is pushing GE hard into an advanced phase of globalization he calls "in country, for the world." That may sound like some celebrity ditty composed for Live Earth, but Immelt is quite serious. He believes that by figuring out how to meet demand in these still relatively poor growth markets, he's going to achieve hard-to-imagine price breakthroughs. And here's what's truly radical: As GE and others do this, these products won't just be sold in emerging markets. Instead they'll filter back into the rich economies - a new deflationary force that should delight buyers but devastate competitors who lack a global footprint. Examples? "Water," says Immelt. "There's a shortage everywhere, even in places like California and Florida. Some systems we're working on in the Middle East, India, and China are trying to do water desalination at $0.001 per milliliter, which is an off-the-charts low cost. We'll never hit that in the U.S. But we'll hit it someplace outside. And the second we do, a huge market is going to open up inside as well." Immelt sees the same thing happening with coal-sequestration technology or MRI scanners, where GE is working on a product in China that could cut prices in half. "At the right cost point, you not only sell it in China, you open up a market among the 35% of U.S. hospitals that today cannot afford to have an MR scanner," he says. "We've got 15 or 20 projects like this that are going to open up big markets around the world over the next five years." GE's not alone. Another market to watch: small cars, where the big American, Japanese, and Korean makers are now tussling with locals to grab share in China and India. The new models that emerge will first be sold locally and then to other emerging countries. "But believe me, the goal isn't just emerging markets," says Hari Nair, president of international for auto parts maker Tenneco, which today gets 58% of its sales overseas. This intense competition is spurring innovation, such as the work Nair's team is doing in India to help Tata Motors introduce a "one lakh" car by 2009. (A lakh is 100,000, as in rupees, or roughly $2,500.) "These environments challenge you to do things you never imagined," says Nair. "You can't just rely on the traditional markets of the West. You've got to be part of new ways of doing business." (For more on the way the emerging world can affect prices, see "How Microsoft Conquered China.") *** "Sustaining the miracle." That was the theme of a conference I hosted as Fortune's deputy editor in May 1997 in Bangkok, a few weeks before a run on the Thai baht metastasized into a vicious deflationary spiral that soon threatened all Asia - and for a time, it seemed, the global economy. Did anyone gassing on in Bangkok see it coming? Ha! It's cold comfort to note we weren't alone. The World Bank had just published a special report on the East Asia economic miracle. The airwaves and op-ed pages back then were larded with paeans extolling "Asian values." But the truth is, we blew it. Here's the other funny thing, though: Ten years later it's clear that, despite the very real pain, it was all little more than a bad bump on an upward road. So where does the world stand today? A little less complacent, at least measured by column inches and airtime. Not a day passes that someone doesn't fret about any number of potential buzz killers: protectionist sentiment in Congress; the humongous U.S. current-account deficit; unprecedented levels of debt buoyed up by know-nothing-and-don't-want-to lenders; the housing slump; and more. On the other hand, measured by what really matters - the money - Mr. Market so far doesn't seem too rattled. Risk spreads, or the gap between historically sketchy paper, such as emerging-market debt or junk bonds, and risk-free Treasuries remain near all-time lows. Somebody's wrong. Our guess - and that's all it is - is that the next big move won't be up. Alan Greenspan pondered this scenario in his farewell address at the Fed's annual shindig in Jackson Hole, Wyo., two years ago. Quoth the maestro: "Any onset of increased investor caution elevates risk premiums and, as a consequence, lowers asset values and promotes the liquidation of the debt that supported higher asset prices. This is the reason that history has not dealt kindly with the aftermath of protracted periods of low risk premiums." Translation: If a correction occurs, what went up fastest - historically more volatile things like Shanghai shares, Turkish bonds, or the last LBO through the gate, say - will go down even faster. (On Wall Street the pros call that kind of volatility an asset's "beta" - it's a Greek term, but think of it this way: as in "beta beware.") Assuming history at some point proves yet again unkind, we don't pretend to know how far things will fall, or when they will bounce back. Nor are we ready to buy the notion whispered in some circles that, hey, since global growth is already so robust, if the U.S. goes into recession, can't the rest of the world keep chugging? That day may come, but it's not here yet. As the world's champion buyer of last resort, the U.S. consumer right now remains the global economy's broad-shouldered, albeit increasingly weary, Atlas. If Atlas shrugs ... look out below. So while it's a wonderful world, as Hank Paulson notes, "it pays to be vigilant." When it comes to financial shocks, Paulson says, we haven't repealed the laws of "economic gravity," so "it's when, not if." (See more of Paulson's comments on the world's economy.) Here's how Lloyd Blankfein is reconciling that potential for short-term fear with long-term optimism. Even as his firm expands abroad, he has lately been lengthening debt maturities (thus lessening Goldman's interest rate risk). And he's been making sure he has plenty of cash on hand, just in case: $50 billion or more by the latest count. Sounds right. There's going to be a lot of growth ahead - for those who stick around to enjoy it. Reporter associate Doris Burke contributed to this article. Europe's top 50 Asia's top 50 From the July 23, 2007 issue

|

Sponsors

|