How we pick the FSB 100

For our eighth annual list, we once again worked with financial research firm Zacks, which ranked public companies with revenues of less than $200 million and a stock price of more than $1.

All companies that meet these criteria are ranked, 1-100, by their three-year annualized rates of revenue growth, EPS growth, and total return to investors. We calculated a log linear growth rate of trailing four quarters EPS and revenue over a three-year period, through the quarter ended on or before Feb. 29, 2008. In other words, we used a "best fit" regression line through the numbers; the steeper the slope of this line, the higher the growth rate. This method provides a better measure of average or normalized growth than a simple point-to-point calculation.

Total return to investors is calculated for the three-year period ended Dec. 31, 2007.

The overall rank is based on the sum of the three ranks. If there is a tie, we compute the average of all three growth rates, and the company with the higher average receives the higher rank.

Banks and real-estate firms are excluded from the list (they would otherwise dominate it), as are adult entertainment companies (for ethical reasons).

Data for our 25 Richest Executives list comes from executive-compensation research firm Equilar.

If you have further questions about the FSB 100, please e-mail fsb_mail@timeinc.com.

All companies that meet these criteria are ranked, 1-100, by their three-year annualized rates of revenue growth, EPS growth, and total return to investors. We calculated a log linear growth rate of trailing four quarters EPS and revenue over a three-year period, through the quarter ended on or before Feb. 29, 2008. In other words, we used a "best fit" regression line through the numbers; the steeper the slope of this line, the higher the growth rate. This method provides a better measure of average or normalized growth than a simple point-to-point calculation.

Total return to investors is calculated for the three-year period ended Dec. 31, 2007.

The overall rank is based on the sum of the three ranks. If there is a tie, we compute the average of all three growth rates, and the company with the higher average receives the higher rank.

Banks and real-estate firms are excluded from the list (they would otherwise dominate it), as are adult entertainment companies (for ethical reasons).

Data for our 25 Richest Executives list comes from executive-compensation research firm Equilar.

If you have further questions about the FSB 100, please e-mail fsb_mail@timeinc.com.

Video

-

Carrizo Oil and Gas' 3-D seismic surveys reveal a wealth of natural gas and oil in the North Texas Barnett Shale. Watch

Carrizo Oil and Gas' 3-D seismic surveys reveal a wealth of natural gas and oil in the North Texas Barnett Shale. Watch -

N.Y.'s legendary Nathan's Famous is dramatically increasing revenues and profit by expanding nationwide sales of its famous hot dogs. Watch

-

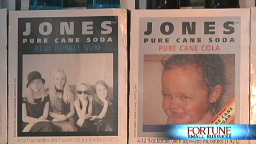

The ups and downs of Jones Soda, the alternative beverage company with a new CEO and a new business strategy. Watch

The ups and downs of Jones Soda, the alternative beverage company with a new CEO and a new business strategy. Watch

Top 3

| State | # of FSB 100 Companies |

|---|---|

| California | 18 |

| Texas | 12 |

| New York | 11 |

| Executive | Total Ownership Value ($ millions) |

|---|---|

| T. Kendall Hunt | 266.2 |

| Donald E. Brown, M.D. | 116.4 |

| George A. Lopez, M.D. | 103.5 |

| Company | Revenue growth (3-yr. annualized) |

|---|---|

| Arena Resources | 132.7% |

| Smith Micro Software | 97.8% |

| TGC Industries | 74.0% |