|

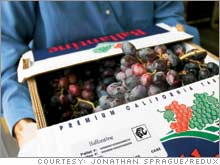

Wireless grapes

Seeking new sales to Wal-Mart, a produce supplier goes high tech.

NEW YORK (FORTUNE Small Business Magazine) - Someday soon, radio-frequency identification (RFID) will allow workers at Ballantine Produce to monitor the temperature of a box of peaches wherever it stops along the supply chain, from a sun-drenched loading dock in central California to a Wal-Mart warehouse on the East Coast. Ballantine will be able to detect fruit that has ripened faster than expected, then ask the warehouse manager to switch the order in which individual boxes go on sale.

"A lot of fruit gets thrown away because it's perishable," says David Silva, IT director at Ballantine (www.ballantineproduce.com), a grower and distributor of grapes, nectarines, and other fruit, based in Reedley, Calif. "If we can help reduce the amount of spoilage with RFID, it's going to save money for both us and retailers." RFID is a ballyhooed technology that uses radio frequencies to transmit data stored on small tags attached to crates, pallets, or individual products. Warehouse employees call up data when the tags pass through the field of a scanning antenna. RFID tags hold far more information than bar codes, and they can be read in places where bar codes can't -- inside a product, for example, or at extremely cold temperatures. The read time is lightning fast (less than 100 milliseconds), and large numbers of tags can be read at once. RFID is expected to increase efficiencies all along the supply chain. But so far the main beneficiary of Ballantine's substantial investment in RFID has been Wal-Mart (Research), the first major retailer to implement the pricey technology. During the first eight months of 2005, Wal-Mart experienced a 16% drop in out-of-stock merchandise at its RFID-equipped stores, according to a University of Arkansas study. In late January a Wal-Mart spokesman told FSB the retailer hopes most of its suppliers will be RFID-compliant within two years. Ballantine hopes that by investing in RFID well before Wal-Mart's deadline, it will take business away from competitors that are slower to adopt the new technology. "We decided this was an opportunity to differentiate Ballantine and its produce," says Silva. The downside? RFID is expensive. So far Ballantine, a 100-employee firm that sold around $80 million of fruit last year, has poured about $400,000 into RFID hardware, software, and tags. That's 50% more than Ballantine would have spent to upgrade its current inventory-management system. Assuming a net profit margin of 15%, Ballantine would have to increase sales to Wal-Mart (currently $12 million a year) by about $2.7 million to recoup its investment. Silva licensed software from Manhattan Associates, a provider based in Atlanta that he learned about at an RFID seminar in late 2004. Like other supply-chain software providers, such as SAP (Research) and HighJump (www.highjumpsoftware.com), Manhattan's application encodes product data on RFID-ready labels. But Manhattan also handles all tech support, including any hardware problems Ballantine has with its third-party RFID readers and tags. In June, Silva slapped RFID tags on some 30,000 pallets of nectarines (about 1% of Ballantine's annual sales volume) and shipped them to a Wal-Mart distribution center in Texas. The tags tracked where the fruit was grown and when it was picked. They even logged the arrival time of pallets as they hit different location points, from dock to truck to warehouse. Each time the crates passed through an RFID-enabled portal (the doors of a delivery truck or a Wal-Mart warehouse), Ballantine saw the data, allowing the company to correct logistical problems from thousands of miles away. "After fruit leaves our dock door, RFID keeps us informed about activities beyond our control," says Scott Albertson, Ballantine's vice president of business development and a third-generation family owner. But so far Ballantine hasn't saved money or time by implementing RFID. In fact, slapping RFID labels on the crates has added a step to the company's order-fulfillment process. "A small manufacturer doesn't necessarily gain a lot from replacing bar codes with RFID," says Shahram Moradpour, CEO of Cleritec Systems, a Silicon Valley firm that designs RFID solutions. "But if Wal-Mart tells them it's this way or the highway, they'll do it." Down the road, Ballantine hopes that RFID will help it keep inventory and labor costs under control. The company currently buys seven million fruit cartons a year. RFID tags could tell Ballantine exactly how many cartons are in the warehouse at any time, allowing managers to cancel unneeded orders. And the company projects payroll savings of $1.5 million to $2 million (10%) annually from equipping fruit packers with RFID devices that will indicate how many workers it actually takes to pack a given number of boxes. But today the firm's focus is elsewhere. "Our goal right now," says Silva, "is to work with the retailers as the technology matures." _________________________________________________________________________________ Some drugmakers use radio frequency identification to combat theft and fraud. See how.

Wal-Mart calls the shots with suppliers, but elsewhere the retailer is frustrated. Find out more. |

|