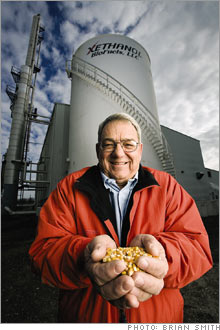

A biofuels startup can't deliver on its promisesA high-tech startup called Xethanol raised $34 million to produce millions of gallons of biofuel. Shareholders have filed suits saying the company is built on hype.(FSB Magazine) -- Christopher d'Arnaud-Taylor was on a roll. It was early 2006, and Xethanol, the New York City firm he had founded, said it was closing in on the Holy Grail of alternative energy. Taylor was telling investors and the press that Xethanol (xethanol.com) would use anything from wood chips to old pizza boxes to make a cheap, clean fuel to replace gasoline - a potentially huge market. With oil prices high, alternative energy had become a darling of investors, and the company was able to line up $34 million of funding, $4 million of it from the venerable investment bank Goldman Sachs (Charts).

During the first half of 2006, Xethanol's (Charts) stock climbed from $2.65 to a high of around $15, giving it a market cap of $245 million. Not bad for a fledgling business with estimated 2006 revenues of $11 million, which had yet to make a cent of profit. Then came an article published in August 2006 on Sharesleuth.com, an investor Web site run by Mark Cuban, the Dallas billionaire, owner of the Mavericks NBA team and founder of several tech companies. The piece questioned Xethanol's claims about its technology and also raised questions about the background and conduct of Taylor, then the firm's CEO, and of some major Xethanol shareholders. Cuban disclosed that he had shorted Xethanol's stock - in effect betting that the price would drop. The share price did collapse and was trading at around $2 a share as this issue went to press. Xethanol cried foul, asserting that Cuban was trying to paint the company in the worst possible light and then profit when its stock tanked. FSB was eager to sort this controversy out. We had written a short piece in our February 2006 issue that was cautiously optimistic about Xethanol's prospects. At the same time, as a champion of small business, we wondered whether the company's claim about Cuban's short-selling campaign held any truth. Was Xethanol a little guy victimized by stock manipulation? After an extensive investigation, we have concluded that Cuban was indeed onto something. Clearly we should have been more skeptical in our initial story ("Fill 'Er Up With Caramel," February 2006). According to scientists, stock analysts, former Xethanol board members, and competitors interviewed for this story, Xethanol exaggerated its experimental ethanol capabilities. The company's repeated announcements that it was on the verge of producing large amounts of a new kind of fuel called cellulosic ethanol triggered a buying frenzy for its stock. At the same time, some company insiders unloaded shares, profiting to the tune of millions of dollars. Taylor recently stepped down as CEO. Two Xethanol directors resigned, disturbed that the company kept hyping its ability to make biofuel. Each sent Xethanol a letter, later filed with the SEC, complaining about the company's behavior. The Xethanol saga has turned into a cautionary tale. Whether public or private, a small company puts itself at risk when it makes heady, hard-to-keep promises to its investors A big idea Urbane and charming, Taylor, 61, says he was born in Madras, India, the son of a British diplomat. According to his r�sum�, Taylor has "directed the strategy, operations, and financial affairs of companies in the U.S., Europe, Africa, the Middle East and Asia and managed the development and execution of corporate turnarounds and entrepreneurial ventures worldwide." For early career experience, he lists executive posts with major corporations such as Northrop Grumman, Reed Elsevier and Unilever. Taylor launched his latest venture in 2000, though its initial name - Freereal-Timequote.com - suggests that he wasn't necessarily looking to go into the ethanol business. That company rapidly morphed into LondonManhattan.com, then Xethanol. In 2003, Taylor acquired a small ethanol plant in Hopkinton, Iowa. In 2004 he bought a second ethanol plant in Blairs-town, Iowa, out of bankruptcy. Xethanol went public on Feb. 2, 2005, via a reverse merger. For about $300,000, Xethanol bought a shell company called Zen Pottery Equipment, a moribund Colorado kiln maker. Xethanol then merged with Zen and was listed on the American Stock Exchange. From the outset, Taylor cast his company as a front-runner in the race to produce ethanol from so-called cellulosic biomass. Translation: While ethanol is generally brewed from corn, entrepreneurs are trying to figure out how to make it more cheaply from waste products - paper pulp, wood chips, those old pizza boxes. Come up with a way to use ubiquitous material to make ethanol cheaply, and a limitless new energy source opens up, pushing down fuel prices, reining in pollution, cutting America's reliance on the unstable Middle East and slowing global warming. You can have your SUV and a future too. |

Sponsors

|