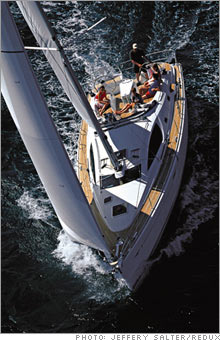

Own a Lamborghini - part timeNew startups are allowing Americans to share ownership of fast cars, luxury yachts, and more.(FSB Magazine) -- If you were to buy the car of your dreams - say, a Porsche 911 GT3 (sticker price, $106,000) - the odds are you'd drive it about 30 days a year and cover maybe 1,000 miles. Those are widely accepted metrics in the exotic-car industry, reflecting the reality that you don't fire up a Porsche 911 to pick up groceries. For boats the numbers are even more stark - most are used just ten to 20 days in season. The rest of the time they gather barnacles while you pay for insurance and maintenance. As a result, high-end luxury products are increasingly being offered in fractional-ownership or shared-access deals. The model started out with real estate time-shares in the 1970s, spread to private jets in the last decade, and is now being applied to sports cars, boats, RVs, helicopters, even handbags and jewelry.

In 2006 four U.S. startups launched in the automotive category alone, according to the Helium Report (heliumreport.com), a Web site based in San Francisco that tracks the fractional-ownership industry. Most of the ventures work in similar fashion - you get access to a car (or cars) for far less than it would cost you to purchase it. In Charlotte a new venture called Privatus (privatus.com) lets you drive two Ferraris and an Aston Martin for about $80,000 every two years. The Classic Car Club (classiccarclub.com), which started in London, offers mint-condition beauties such as a 1965 AC Shelby Cobra or the 1972 Jaguar E-Type Roadster, and recently added new exotics such as the Ford GT ($150,000, give or take). Classic has a U.S. location in New York City and plans to open two more, in Los Angeles and Miami, later this year. But the newest and perhaps most upscale is Collexium, based in Fort Lauderdale. Founder Blas Garcia Moros spent 15 years rising through the ranks at Microsoft (Charts) and ultimately ran the company's operations in south Asia. When he stepped down in 2000, he thought he'd enjoy the retired life, but, as he puts it, "Retirement is overrated." While shopping for a Ferrari, Moros, 45, looked around at other makes and found it hard to decide. That led to a business he thought he could start: a club for exotic cars. Moros spent three years planning Collexium (collexium.com) and launched it in November. The venture offers access to ten high-end sports cars, including two Bentleys, two Ferraris, two Lamborghinis and a Lotus Elise, among others, for an initiation fee of $15,000 plus an annual charge of $15,000. Members can drive any of the ten cars whenever they want, for a total of about 30 days a year. (The arrangement is run on a point system that varies depending on demand for the car, season, and day of the week.) Clients must have their own insurance, which the club supplements with additional coverage. Collexium's first club is only for drivers who live in south Florida, but Moros envisions future operations, most likely in warm-weather cities where the cars can be enjoyed year-round. Unlike members of some car-share startups, such as Curvy Road in Chicago (curvyroad.com), Collexium drivers do not own a piece of any car. The club holds all the equity in its ten autos, plus any future additions, and the dues merely offer members the right to use them. Moros says his model is the simplest and doesn't limit members to a single vehicle. "The more the variety the better," he says. "It's not about driving the one amazing car that you've always dreamed about. Hopefully we can accomplish that, but it's also about driving cars you would never purchase and don't want to drive often but want to try once." One of Moros's partners in the venture, and his COO, is Larry Murrah, 57, who ran Ferrari and BMW dealerships in the area for decades. The two say their ideal customer already owns an exotic automobile. "They don't say, 'Wow, this is the first time I've ever driven a Lamborghini and it may be the last time, so let's get ready to squeeze every last minute out of it,' " Moros says. "They're not going to burn rubber." His goal is to have about 100 members signed on by the end of 2007; at presstime he had about a dozen. Officially the membership list is invitation-only, but Moros has a membership coordinator for those interested in joining. Early signees include local entrepreneurial successes such as John Henry, principal owner of the Boston Red Sox; Steve and Tom Shelton, owners of several car dealerships, including a Ferrari showroom near the Collexium clubhouse; and Manny Medina, who launched a tech company called Terremark in 1980 and has grown it to more than $62 million in annual sales. "I used to have a Porsche 911," says Medina, 54. "Red, 1994. But I hardly ever used it. I've always loved cars - I had a Shelby Cobra and an Aston Martin DB7, but I don't have time to be tinkering with them." |

Sponsors

|