NEW YORK (CNN/Money) - The dollar tumbled Friday and gold jumped as investors worried about the growing possibility of war with Iraq.

Treasury prices rallied along with gold, while stocks took a beating in the United States and in Europe.

Around 4 p.m. ET, the euro jumped nearly 1 percent against the dollar to buy $1.0838, up from about $1.0750 late Thursday, notching both new session and three-year highs. It's the seventh time in seven days the euro has rallied against the beleaguered U.S. currency.

The dollar also fell as low as ¥117.56, from about ¥118.10 late Thursday, and bought ¥117.73 yen in late trading in New York.

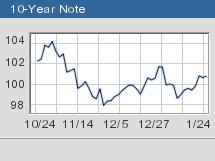

In the Treasury market, the benchmark 10-year note climbed 3/32 of a point to 100-18/32, pushing the yield down to 3.93 percent from 3.95 percent Thursday. The 30-year bond rose 7/16 of a point to 107-26/32, yielding 4.86 percent.

The five-year note gained 2/32 of a point to 100-18/32, yielding 2.87 percent. Only the two-year note failed to join the advance; it stood unchanged at 100-6/32, yielding 1.65 percent.

Spot gold was quoted at $368 an ounce, after touching a high of $370.20, its highest since December 1996. Gold prices have risen about 15 percent in the past two months as traders seek safe havens for their money.

Worries about potential military action in Iraq, weak stock prices and the sluggish U.S. economy have all convinced investors that Treasury yields, which move in the opposite direction of prices, will stay low and perhaps go lower, traders said.

U.N. weapons experts plan to deliver their widely awaited report on the first two months of arms inspections on Monday, but Washington has expressed disagreement with its allies, especially France and Germany, over whether Baghdad should be disarmed by force.

"The geopolitical events scheduled for next week could be positive for Treasurys," said Merrill Lynch Government Securities fixed-income strategist John Spinello. "Anticipation of next week's [inspections report] makes most people not want to be short going into next week."

Bill Sullivan, economist at Morgan Stanley, said there was talk that Secretary of State Colin Powell will present evidence next week that Iraq has weapons of mass destruction "the way [then-U.S. United Nations representative] Adlai Stevenson presented incontrovertible evidence that there were Russian missiles in Cuba during the Cuban missile crisis."

In other currency news, Bank of Japan Governor Masaru Hayami said Friday the central bank would carefully watch the impact of foreign exchange moves on the Japanese economy, but noted also that currency movements could not be manipulated easily.

The market has been on guard for possible yen-selling by Japan to keep the yen from appreciating too fast and hurting the nation's exporters. A weak yen tends to make Japanese goods more competitive in other countries.

-- from staff and wire reports

|