NEW YORK (CNN/Money) - Bond prices stayed in the minus column in late trading Wednesday while stocks tried to figure out whether Colin Powell's speech at the United Nations had boosted the odds of a U.S.-led military strike against Iraq.

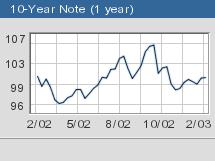

Around 4:00 p.m. ET, the benchmark 10-year note lost 20/32 of a point in price to 99-30/32, pushing the yield up to 4.01 percent. The 30-year note dropped 1-3/32 to 107-25/32, yielding 4.86 percent.

The two-year note dipped 3/32 of a point to 99-26/32, pushing the yield up to 1.72 percent, while the five-year note fell 12/32 of a point to 100-2/32, pushing the yield up to 2.99 percent. When Treasury prices fall, the yields rise.

Powell presented what he said was new evidence of Iraq's unwillingness to comply with U.N. disarmament mandates to the body's Security Council. But Powell's argument for the use of force failed to prompt a safe-haven bid for Treasurys or stocks.

Investors also sold bonds after a Treasury statement outlining the government's increased borrowing requirements and declaring a shift in debt issuance patterns.

The Treasury said it would sell $42 billion in new debt, including $24.0 billion in five-year notes and $18.0 billion in 10-year notes, in its quarterly refunding next week. It also instituted a regular reopening policy for five-year notes, starting with the May 15, 2008, issue, to occur one month after the initial auction and two months before the next auction for a new note.

In addition, the Treasury Department warned it was about two weeks away from hitting the limit on the government's borrowing authority, possibly setting the stage for a contentious battle in Congress.

As of Tuesday, the debt subject to the limit stood at $6.334 trillion, about $66 billion from the $6.400 trillion borrowing limit. Without a raise in the limit, the Treasury in theory runs the risk of an unprecedented default on the nation's debt. That is unlikely, however, as Congress has always acted before at the last moment.

Dollar surges on Powell's speech

Powell's U.N. speech lifted the dollar from four-year lows against the euro, as traders were heartened that Washington seemed to be convincing its allies that Iraq would have to be disarmed by force.

Europe's common currency fell nearly 2 cents from its London trading high above $1.0938, trading near $1.079 around 4:00 p.m. ET, and down more than a percent from its previous U.S. close.

The U.S. dollar also stretched its gains against the yen, vaulting above the psychologically key ¥120 level, up 0.30 percent on the day and more than a full yen above its offshore trading low. Fears that Japan could sell its currency in favor of dollars underpinned the U.S. currency against the yen.

-- from staff and wire reports

|