NEW YORK (CNN/Money) -

Merrill Lynch said Thursday it will pay $80 million to end a federal probe into two of the No. 1 brokerage's deals with Enron during the height of the bull market.

In settling with the Securities and Exchange Commission, Merrill neither admitted nor denied wrongdoing. Nor did the brokerage elaborate beyond saying the settlement covered two 1999 deals with the now-bankrupt energy trader.

But a person familiar with the matter said the transactions involve a Nigerian energy barge deal and energy trades executed that year.

The settlement comes 14 months after Enron filed for bankruptcy protection, collapsing under a massive debt load hidden behind off-balance sheet partnerships. The collapse brought investigations, hearings, criminal charges and lawsuits that continue today.

Merrill, along with J.P. Morgan Chase and Citigroup, was called before Congress last summer and accused of creating financial transactions that enabled Enron to disguise its true financial condition.

| RELATED STORIES

|

|

| Report: fraud finding for Merrill

|

|

|

|

The brokerage later fired two executives who declined to testify before lawmakers. With Thursday's announcement, Merrill's embarrassing tussle with the SEC over Enron appears to have passed.

"This settlement would conclude the SEC's investigation into Enron-related matters with respect to the company," Merrill said in a statement released after Thursday's market close. The SEC declined to comment on the matter.

For New York-based Merrill, the settlement is the latest in a series of investigative costs. The company is one of 12 financial institutions that recently settled a $1.4 billion-plus probe over allegations of tainted stock research.

The $80 million will be charged to the company's 2002 fourth-quarter results, which Merrill reported last month. As a result, the company said the payment in disgorgement, penalties and interest will be recorded in its 2002 10-K report to be filed in March.

In Thursday's agreement, Merrill Lynch also said it would consent to an injunction barring it from violating federal securities laws. The deal, Merrill said, is subject to the drafting of settlement papers and commission authorization.

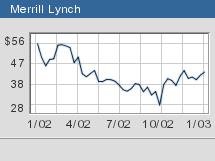

Merrill (MER: Research, Estimates) shares fell 40 cents to $34.58 during the regular trading session, widening their year-to-date loss to 9 percent.

The Nigerian barge deal is one of several that is part of an ongoing criminal case against former Enron Chief Financial Officer Andrew Fastow.

Click here for financial stocks

Fastow in November pleaded not guilty to a 78-count fraud and obstruction of justice indictment; more charges against him and other Enron executives are expected shortly.

Federal prosecutors have described the Nigerian barge deal as an "asset parking" transaction that allowed Enron, through Fastow-controlled partnerships, to improperly record $28 million in cash flow and $12 million in earnings from a bogus sale to a third party.

Merrill is not named in the indictment and is not charged with any crime, but the court papers refer to a "major financial institution" as the buyer.

-- Reuters contributed to this report

|