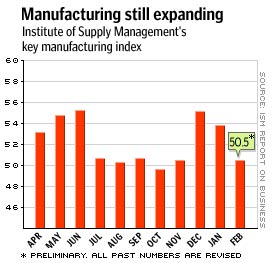

NEW YORK (CNN/Money) - Manufacturing activity in the United States expanded for the fourth straight month in February, the nation's purchasing managers said Monday, though the pace of activity was slower than economists expected.

The Institute for Supply Management said its index of manufacturing activity fell to 50.5 from 53.9 in January. Any reading above 50 percent indicates expansion in the sector. Economists, on average, expected an index reading of 52, according to Briefing.com.

"While there is some evidence of business picking up, particularly in electronics, many [businesses] express concerns," the ISM report said. "Higher energy prices are squeezing already thin margins. The threat of war is viewed as a major deterrent in a number of industries."

The ISM's "new orders" index fell to 52.3 from 59.7, while its employment index fell to 42.8 from 47.6, indicating the pace of layoffs in the manufacturing sector picked up in February.

Economists had hoped for better performance from the national ISM report, based on a stronger-than-expected purchasing managers' report on Chicago-area manufacturing last week.

But other regional indicators, from the Philadelphia and New York Federal Reserve banks, showed a sharp slowdown in the month.

"[This is] a significant downside shock, and perhaps a sign falling consumer sentiment is rattling companies," said Ian Shepherdson, chief U.S. economist at High Frequency Economics Ltd. "A further drop next month will see the [Federal Reserve] easing again."

The report helped erase earlier gains in U.S. stock prices, while Treasury bond prices continued to fall.

The U.S. manufacturing sector has been in trouble for more than two years; its recession began several months before the broader U.S. recession that began in March 2001, and it ended much later.

| Related stories

|

|

|

|

|

And the sector has continued to cut jobs relentlessly. Though manufacturing jobs are only 15 percent of all the private-industry jobs in the United States, the number of job cuts in the sector -- 1.7 million -- account for 77 percent of the 2.2 million jobs cut in all U.S. private industries since March 2001.

Most economists blame the possibility of a U.S.-led war in Iraq for stagnant business activity in manufacturing and other sectors. Until uncertainty about the possibilities of such a war is cleared up, businesses will delay making big investment plans that could lead to more hiring, according to this theory.

"Business confidence is very low, and thus they're maintaining as cautious an approach as possible to their activity, whether that's hiring, building inventory or anything else," said Brian Fabbri, chief economist at BNP Paribas.

Higher oil and natural gas costs already are crimping business activity, joining other high commodity prices to put pressure on corporate profit margins -- the ISM's "prices paid" index jumped to 65.5 from 57.5 in January.

Most businesses can't pass these higher prices on to consumers, who are growing more cautious amid lingering labor-market weakness, so they have to keep costs low in order to make a profit, causing further delay in hiring and a slowdown in wage and salary growth.

The Fed cut its target for short-term interest rates 11 times in 2001 to fight the effects of the recession and the Sept. 11 terrorist attacks. It left rates alone for most of 2002, finally relenting to cut rates again in November, when the economy again showed signs of weakness.

Fed policy makers, led by Chairman Alan Greenspan, hold the consensus view that the post-war period will bring renewed business activity. Most economists doubt the Fed will cut rates again at its next policy meeting, scheduled for March 18.

But the Fed is certainly keeping an eye on the recent slowdown in manufacturing activity, which has coincided with renewed recession fears, brought on by an upturn in oil prices and a plunge in consumer confidence to the lowest levels since the fall of 1993.

"All of this should make the Fed nervous, but once the geopolitical uncertainty is removed, we may get a small bounce back anyway, even if there are other [problems] in the economy," Fabbri said. "From the Fed's perspective, it's best not to do anything until the risk's gone."

|