NEW YORK (CNN/Money) -

The United States, backed by Britain and Spain, on Monday ended diplomatic efforts to disarm Iraq and this led to a stock market rally as the uncertainty that has plagued Wall Street for months seemed to finally lift.

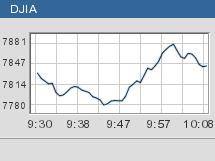

With an imminent war against Iraq appearing to be a done deal, the Dow Jones industrial average (up 172.27 to 8031.98, Charts) and the S&P 500 index (up 18.10 to 851.37, Charts) rallied more than 2 percent. The Nasdaq composite (up 36.52 to 1376.85, Charts) posted a gain of almost 3 percent shortly before 11:00 a.m. ET.

Washington, London and Madrid decided not to push for a Security Council vote on a second U.N. resolution giving Iraq a deadline to disarm. The United States advised U.N. weapons inspectors to leave Iraq in anticipation of likely action and President Bush prepared to address Americans at 8:00 p.m. ET. (For more details on the latest developments, go to CNN.com.)

Armed with this information, Wall Streeters rushed to cover their short positions and pushed the market sharply higher. This behavior was in sharp contrast with the market's performance recently, in which investors sold stocks off every time war appeared more likely.

Few issues stood out except the ones that had negative corporate news to add to the war fear. Among them, automakers Ford (F: up $0.09 to $6.85, Research, Estimates) and General Motors (GM: up $0.22 to $32.22, Research, Estimates), a Dow component, took a beating after J.P. Morgan cut its 2003 earnings estimates for the two companies based on forecasts for lower-than-expected sales and production levels in North America.

Among the few stocks that rose, Wal-Mart (WMT: up $1.86 to $51.22, Research, Estimates) gained nearly 2 percent after the world's largest retailer, said strong seasonal goods sales would allow it to meet its sales forecasts for March and April.

Market breadth turned decidely positive, both on the New York Stock Exchange and the Nasdaq, but volume remained relatively light.

U.S. Treasury bonds staged a sharp turnaround, with the benchmark 10-year note losing 1-9/32 points in price, its yield shooting up to 3.85 percent . The dollar fell against the yen but scored a modest advance against the euro.

The prospect of imminent war in the Middle East continued to drive oil prices higher. Light sweet crude futures rose 54 cents to $33.90 a barrel in New York. Gold futures climbed $3.40 to $340.00 an ounce in New York.

Overseas markets also suffered a bout of war jitters. Stocks in Europe fell sharply and Asian markets tumbled overnight.

|