NEW YORK (CNN/Money) - Sports broadcasting has become a sea of red ink for broadcasters. But executives with Viacom Inc.'s CBS insist it is keeping its head above water, and making a profit despite steep rights fees.

"For us, sports is a very challenging but successful business," said Sean McManus, the president of CBS Sports.

|

|

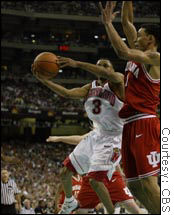

| CBS is paying significantly more to broadcast this year's NCAA basketball tournament, but coverage and ad revenue could take a hit from war coverage. |

McManus is one of the few sports executives not crying poor. A year ago, competitor Fox Entertainment Group took a $387 million charge for losses from its National Football League deal, which virtually mirrors a CBS deal, part of a $909 million charge overall for sports losses. But Viacom President Mel Karmazin insists CBS won't be taking any charge for its sports fees.

NBC has dropped its broadcasts of the National Basketball Association, the NFL and Major League Baseball all within the last five years due to an unwillingness to pay increasing rights fees. However, CBS insists that despite paying top dollar for a select group of premier events, it's making money, or at least breaking even.

"We can spend whatever we want to acquire rights," McManus told a recent panel on the problems of sports broadcasting. "But at a minimum, we have to make $1 on the deal."

The network is preparing a bid for later this summer to try to win rights for the 2010 Winter Olympics and the 2012 Summer Olympics. One or both could possibly be in North America, making them more valuable for a U.S. network. But the rights fee for the Winter Games is likely to top the $613 million being paid by NBC for the 2006 Games in Torino, Italy, while the 2012 rights are also expected to top the $894 million that NBC is paying for the 2008 Games in Beijing.

Problems immediately ahead

But before it gets to the Olympics bidding, the next four weeks will be a challenging test for CBS and its strategy on sports.

First up is the NCAA men's basketball tournament, one of the premier sporting events in the nation, one that normally provides 10 nights of well-rated prime-time programming over three consecutive weeks.

This year is the first year a of a new 11-year, $6.2 billion rights deal between CBS and the NCAA, under which CBS is paying more than any other programming other than the NFL deal. The average $565 million annual payment is more than 160 percent greater than the average payment under the old deal.

| Related stories

|

|

|

|

|

But the games, set to start Thursday evening, could end up being pre-preempted by the network's war coverage. Karmazin told analysts during the company's conference call last month that the network could go with one or two days of non-stop news coverage once any hostilities start in Iraq.

With NCAA President Myles Brand saying Monday that his organization was exploring possibly postponing some of the games, the war will pose grave logistical problems during the crowded opening weekend of the tournament, so the network will likely have a difficult choice to make.

The network went with only brief news coverage, then broadcast regular-season NFL games on Oct. 8, 2001, when the U.S. started its attack on Afghanistan. But this time, CBS seems to be leaning towards bumping some of the games to Viacom's cable networks such as TNN, MTV or Black Entertainment Television and going with news on the broadcast network.

The first two days of the tournament have 16 games each, with many games competing with one another. Cable networks can't carry different games of regional interest in different markets, the way CBS affiliates can. They have to carry the same games in either the entire nation or at best separate games in each of two east-west regions. That will means even if NCAA fans all had cable, the games will likely get lower ratings for the first round due to fans being locked out seeing the games they want to see.

McManus said Viacom probably won't use its other broadcast network, UPN, because so many of the affiliates are owned by competitor Fox. Last Thursday, he said it's too difficult to say what will be broadcast when or where.

"It's completely a line-of-scrimmage decision," he said. "It's impossible to predict what we'll do. We'll hope we don't have to do anything."

The lateness of the NCAA tournament, normally called March Madness but scheduled to be completed this year on April 7, was already going to push some of Viacom's normal first quarter profits into the second quarter. Now it might lose some revenue and profit altogether, depending on what kind of ratings any games shifted to cable can get. Even if there are no games shifted to cable, the war coverage could draw away some typical viewers.

When shows don't get the promised level of ratings, advertisers normally get additional ad time to make-up for the fewer-than-expected viewers. But much of the inventory of prime-time ad time is already sold out for the rest of this television season, so there could be refunds this time.

No ads at Augusta

The next sports headache for Viacom and CBS is the Masters golf tournament, set for April 10 to 13, the best-rated golf tournament of the year and normally a nice profit center for CBS, even with only four minutes of commercials an hour that were traditionally allowed by the tournament's organizers. But CBS only had to pay a relatively modest $2 million to $3 million rights fee to Augusta National Golf Club, which hosts the tournament.

But this year protests about Augusta's refusal to have any women members has prompted a public relations battle between the National Council of Women's Organizations and Augusta National chairman Hootie Johnson, who demanded that CBS not carry any advertising on this year's broadcast so that the tournament wouldn't have any sponsors who could be pressured by women's groups. The NCWO has asked CBS not to broadcast the tournament, which it has declined to do. Other than saying it will go ahead with the broadcast, it won't comment on the controversy.

Click here for a look at media and entertainment stocks

"This is a difficult time for CBS," said Neal Pilson, a former president of CBS Sports and now an industry consultant. "They're the innocent party in this controversy. They have an obligation to the affiliates and to the viewers to show the tournament. In the overall framework of CBS and Viacom, it's not a major hit, but they will be foregoing the sponsor revenue."

|