NEW YORK (CNN/Money) -

The war, the economy and a late Easter have eroded retailers' sales of late, but industry watchers say there are companies -- including Houston-based Stage Stores and Florida-based Chico's -- that could lead the way back from the current slump.

"For long-term value investors, I agree with the premise that retail stocks could do well when the war ends," said James Awad, money manager with New York-based Awad Asset Management. "But investors have to get in early to buy some of these stocks, like Stage Stores."

The retailer operates 354 stores under the Stage, Bealls and Palais Royal names, mainly in 13 states in the South and Midwest. The company, which emerged from bankruptcy in August 2001, sells fashion apparel, cosmetics, gifts and footwear, including top brands such as Tommy Hilfiger, Liz Claiborne, Levi Strauss, Chaps and Polo, alongside Stage Stores' private-label merchandise.

Awad does not own Stage (STGS: down $0.16 to $21.02, Research, Estimates) stock, but his firm owns about 500,000 shares of the company.

"The stock is cheap, not well followed, and I think it's undervalued," Awad said. "The stock currently trades at about $21, and I think it will earn about $2.60 a share for the year."

Last year Stage had total sales of $876 million, up 2 percent from the prior year. The company last month posted a fourth-quarter profit of $16 million, or 81 cents a share, up from $15.8 million, or 77 cents, a year earlier. That beat Wall Street's profit forecast of 78 cents a share for the latest quarter.

At the same time, the company forecast first-quarter earnings of 80 to 85 cents a share, compared with analysts' forecast of 81 cents a share.

But economic and geopolitical concerns did hurt its sales in the quarter. Stage posted a drop in its fourth-quarter same-store sales -- or sales at stores open at least a year -- of 6.8 percent.

"Stage's March sales [comparisons] are likely to be difficult with the late Easter shift and also because a lot of the U.S. military bases are located in the Southwest. That's its main market and it could lose business there because of the war," according to an analyst with Buckingham Research Group.

"But at $21, it's really one of the least expensive names in the retail group. The company's strength is that it offers a unique concept in smaller towns with the selection of brands that they carry," he said. "Stage also has a new management team since it emerged from bankruptcy in August 2001. The company's been opening new stores and that's generating positive cash flow. Meanwhile, the company also has a history of buying back shares with excess cash."

The company's stock currently trades about 26 percent above its 52-week low of $16.81 hit in October and has a P/E multiple of about 7.

But analysts said that one factor that could be a potential headwind against the company's stock price is its credit card business, especially in the wake of Sears' (S: up $0.20 to $24.35, Research, Estimates) protracted problems with its credit card operations.

"The company has already talked about selling its credit card business. If that happens, it could give a real pop to the stock," said Awad.

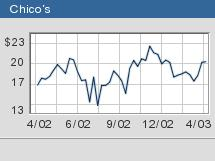

Specialty women's apparel retailer Chico's FAS (CHS: up $0.32 to $20.32, Research, Estimates) is a favorite retail pick of fund manager Romeo Dator. The Fort Myers, Fla.-based company operates 392 women's specialty stores, under the names Chico's and Pazo in 41 states.

"The stock trade about 17.5 times 2003 earnings. That's at a premium compared with the other apparel companies out there but it's also growing faster than the other companies," Dator said.

Chico's, which caters mostly to a clientele of women 35 or older, has managed to grow its sales despite an overall slump for apparel retailers.

"Chico's has a very loyal core customer base. Its products are good quality and not fashion-oriented," Dator said. "But Chico's is also trying to catch the younger customers. The new Pazo stores cater to women between 25 and 35 years old."

The retailer in February posted a fourth-quarter profit of 17 cents a share, up from 12 cents a share a year ago and a penny better than Wall Street's forecast of 16 cents a share.

Sales for the quarter rose 36.4 percent to $138.3 million, while sales at stores open more than a year rose 11 percent.

Chico's sales totaled $531 million last year, up 40 percent from the previous year.

Dator does not personally own Chico's stock, but his fund, U.S. Global All American Equity Fund, owns about 6,000 shares.

|