NEW YORK (CNN/Money) -

General Electric Co., a company that stood for 1990s corporate supremacy like few others, by one measure returned to the top Thursday when it squeaked by Microsoft as the No. 1 company by market value.

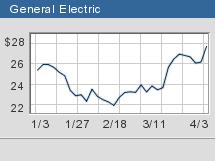

A share price gain of 50 cents, or nearly 2 percent, to $27.55 gave GE, with 10 billion shares outstanding, a $275.5 billion market value. That edged Microsoft (MSFT: Research, Estimates), which finished Thursday's session worth $275.3 billion following a gain of 1 cent to $25.73 a share. Microsoft has 10.7 billion shares outstanding.

When it comes to stock market leadership, the two companies have flip-flopped for years, most recently last May, when Microsoft overtook GE.

This time, the return of GE, which is involved in broadcasting, light bulbs, reinsurance, aircraft engines and medical equipment, is being cast in humble terms.

"I would say that the negative sentiment on the company was washed out," said Mark Demos, who follows the company for Fifth Third Bancorp, which owns about 14 million GE shares.

Negative sentiment enveloped GE (GE: Research, Estimates) this time last year, when investors spooked by accounting scandals shunned acquisitive companies with complicated bookkeeping. Comparing GE with Enron, the energy trader that inflated profits before going bankrupt, turned out to be unfair.

But the comparison came during a year of perception problems capped when Jack Welch, the company's legendary former CEO credited with building so much shareholder wealth, gave up most of a retirement package that was criticized as excessive.

Proxy for the economy?

A mature company like GE, the only original member still part of the Dow Jones industrial average, may never escape questions about how it can keep expanding profits at a brisk pace.

In 2001, when the economy slipped into recession for the first time in a decade, Fairfield, Conn.-based GE said profit rose 7 percent to a record $15.1 billion.

Morgan Stanley's chief economist, Stephen Roach plans to formally tell clients Friday he is forecasting a world recession in 2003. That would come two days after GE Chief Financial Officer Keith Sherin said earnings per share at GE, which has been called a proxy on the economy, could gain as much as 12.6 percent this year.

"It's a huge company," said Robert Friedman, a Standard & Poor's analyst who has been a GE skeptic. "It can only grow at a certain rate."

But investors have lost some of that skepticism. GE stock, which fell 39 percent last year, is up 24 percent since Feb. 13.

"More people are becoming more comfortable with the earnings outlook," said Jeff Graff, who watches GE for Victory Capital Management, which owns about 28 million GE shares.

GE plans to report its first-quarter profit April 11. Analysts surveyed by First Call expect that GE earned 32 cents a share, down from 35 cents a share in the year-ago quarter.

Sherin, the CFO, told analysts and investors Wednesday that the company's medical equipment and financial services unit are performing better than expected.

But questions remain. The company's aircraft engine business is reliant on an industry affected by war in Iraq, terrorism fears, and a mysterious and deadly virus that began in Asia. At the same time, GE's plastic business has endured rising energy costs. The price of oil rose to nearly $40 a barrel this year as the United States neared war with Iraq.

|

|

| Jeffrey Immelt |

GE's CEO, Jeffrey Immelt , who had been president and CEO of GE's Medical Systems unit, took over the top job four days before the Sept. 11 terrorist attacks.

Unlike Welch, who Fortune magazine once named "Manager of the Century," Immelt has not become the face of GE. But Immelt has stood out by responding to calls for improved corporate governance. GE held its first-ever investors' conference call under Immelt, who was behind the company's decision to expense stock options.

Still, David Frail, a GE spokesman, said GE's return Thursday to market cap leadership is not on management's radar screen.

"We just don't worry about it too much," said Frail. "It's like the old adage, 'you try to watch the stock market every day and you go blind.'"

|