NEW YORK (CNN/Money) -

Here's a clue for the summer: Mint, lemon 'n lime, orange and vanilla. No, it's not ice cream. It's Coke versus Pepsi in the latest round of the "cola wars."

Coca-Cola is tinkering with a first-ever product line extension for its lemon-lime soft-drink Sprite called Sprite Tropical Remix. It's also coming out this year with a mint-flavored version of Sprite called Sprite Ice.

|

|

| Coca-Cola adds some punch to its lineup with the new Sprite Tropical Remix. |

Industry watchers say Coke's pick of Sprite as its "golden child" this year is clever, given that Sprite is the company's third-strongest brand in the United States.

Consumers in New York have already got their first taste of Sprite Tropical Remix. The rest of the nation has to wait just a few months more.

Meanwhile, Sprite Ice debuts at the end of this month but only in Canada and Belgium, according to a company statement. There's no indication when, or if, the product will come to the United States.

Coke could not be reached for comment.

For its part, Pepsi is countering Coke's expansion of its lemon-lime brands by boosting its nationwide distribution of Sierra Mist in 2003. Pepsi launched Sierra Mist in 2000 and last year.

"Prior to Jan. 1 of this year, Sierra Mist was available in 60 percent of the United States. Since then the distribution is up to 92 percent of the country," said Bart Casabona, spokesman for PepsiCo.

|

|

| PepsiCo is planning a late summer launch of orange-flavor Mountain Dew LiveWire. |

"For us the lemon-line beverages are one of the most widely consumed drinks categories. So it made sense for us from a business standpoint to have a big national brand alongside our other brands," Casabona added.

Also in Pepsi's arsenal this year is a summer launch of Pepsi Vanilla, Diet Pepsi Vanilla and Mountain Dew LiveWire, an orange-flavored variety of the drink.

"Summer is the highest-volume period of the year for the beverage industry," said John Sicher, editor of Bedford Hills, N.Y.-based Beverage Digest. "But it's not just the new products that will get the attention. The promotions and advertising are also very important for both companies."

Pepsi isn't holding back with its advertising money. The company is launching a May 1 summertime promotion, "Play for a Billion," in which consumers will compete for large cash prizes, including a potential ultimate payout of $1 billion in September.

Coca-Cola debuted its latest "Real" ad campaign for its core Coca-Cola brand earlier this year, featuring an abundance of celebrities, including one with actress Penelope Cruz guzzling a bottle of Coke in one take.

Coke's still No. 1

No matter how hot or "cool" the flavor feud becomes this summer, Coke won't be sweating it too much.

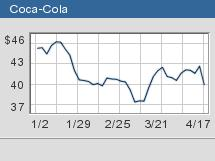

Coca-Cola (KO: up $0.50 to $40.40, Research, Estimates), the world's largest beverage maker, is still comfortably perched in its slot as the U.S. market leader, according to Beverage Digest.

In fact, the company increased its market share of the $63 billion U.S. soft-drinks market by 0.6 percent to 44.3 percent in 2002. PepsiCo (PEP: up $2.64 to $42.54, Research, Estimates), the No. 2 company, saw its market share dip by 0.2 percent to 31.4 percent.

Industry analysts credit Vanilla Coke, launched last year, as a huge success for Coke similar to Pepsi's breakthrough in 2001 with Mountain Dew Code Red, a cherry-flavored variation of the drink.

But then came Pepsi's Blue a year later, a berry-flavored version of its cola that fizzled with consumers.

"The Mountain Dew brand hasn't done very well overall for Pepsi and Pepsi Blue didn't take off," said Ann Gurkin, analyst with Davenport & Co. "This year Coke has better innovations in the pipeline."

According to Beverage Digest, Coca-Cola owned four of the top-10 selling brands in 2002 -- Coke Classic, Diet Coke, Sprite and Caffeine-Free Diet Coke. PepsiCo owned three -- Pepsi-Cola, Mountain Dew and Diet Pepsi.

But the strongest performer in last year's Top 10 group belonged neither to Coca-Cola nor Pepsi. It was Cadbury Schweppes' Dr Pepper. Cadbury Schweppes (CSG: up $0.46 to $22.06, Research, Estimates) is the third-largest beverage maker in terms of market share behind Coke and Pepsi.

Where does bottled water fit in?

According to Beverage Digest's John Sicher, innovation of beverage products is really a key driver of sales for companies, especially with the soft drinks market experiencing slowing sales.

"Sales have slowed from annual rates of growth of 3 percent in the 1990s to less than 1 percent," said Sicher. "That has largely to do with the growth of bottled water, which is growing at 26 percent a year. Pepsi right now has the No. 1 brand with Aquafina. Coke is No. 2 with Dasani."

|

|

| Bottled water is waging a beverage war of its own. |

"But soft drinks sales overall are holding up well," Sicher added. "If you're looking at the first-quarter U.S. volume growth this year for both Coca-Cola and PepsiCo, it's important to consider that other factors were at play including bad weather and anti-U.S. sentiment around the world."

In the first quarter, Coca-Cola's volumes grew 4 percent overall, below the company's 5 percent to 6 percent long-term annual growth forecast. Volumes in North America, the company's largest and most important market, were up 3 percent.

PepsiCo Beverage's first-quarter volumes grew 3 percent overall in 2003, while volume in North America rose half a percent.

Coca-Cola Wednesday post a first-quarter profit that met Wall Street's estimates, while Pepsi Thursday posted a first-quarter profit of 45 cents a share, beating analysts' estimates by 3 cents a share.

|