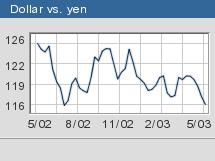

NEW YORK (CNN/Money) - Despite various protestations that the strong dollar policy is the same as it ever was, it's pretty clear that the Bush administration and the Federal Reserve are happy to see the greenback's decline.

Their counterparts overseas, however, may not be so pleased.

So long as it happens in a stately manner, a declining dollar can look like just what the doctor ordered for the battered U.S. economy. It helps U.S. exporters, because the goods they sell abroad become cheaper in local currency terms. It helps companies at home, because the goods they sell become more competitive versus imports.

It all sounds lovely, but there's one big problem: A weaker dollar necessarily means that the world's other major currencies, the euro and the yen, get stronger. And with the European and Japanese economies also weak, and also facing the threat of deflation, officials there will not be happy to sit on their hands while watching their currencies climb.

In fact, Japan has already begun to fight to keep the dollar from falling too far.

"We're seeing Japan aggressively acting to keep the yen steady against the dollar and stop the process of broad dollar weakness from turning into broad yen strength," said Brown Brothers Harriman economist Lara Rhame.

The Bank of Japan said Tuesday that it will ease monetary policy -- in effect introducing more yen into the economy. This followed what is believed to be a massive intervention Monday, where the Bank bought dollars for yen in an effort to break the greenback's slide.

Europe has so far not shown much concern over the dollar's slide, but this may not last long. Europe's economy is in sorry shape. In the fourth quarter, the region's gross domestic product grew at just a 0.7 percent rate. The first quarter looks, if anything, grimmer -- German GDP contracted an annualized rate of 0.9 percent and Italy's GDP slipped by 0.4 percent.

Given this backdrop, the euro could end up being far too strong for European officials' taste.

"We are clearly forcing the Europeans to do something," said Aeltus investment management strategist Jim Griffin, "because if they stand around and do nothing they'll face deflationary pressures of their own."

When does Europe cry uncle and try to push the euro lower? Morgan Stanley has pegged it at $1.20 -- not far from the current $1.17.

Less is more

If Europe joins the fray, we will have entered the world of competitive currency devaluation, where everybody is trying to make their currency weaker than the others. But obviously this can't occur, since the world of currency trading is a zero sum game.

"If none of us will allow our currencies to appreciate against the others," said Northern Trust economist Paul Kasriel, "then they'll all depreciate against something else. Gold, copper, oil."

That may not necessarily be a bad thing. If all the world's currencies are falling against commodity prices, well, that's inflation -- just the thing we need to prevent a deflationary funk and get things going. It would prompt consumers and businesses around the world to worry that the prices they pay for things later will be substantially higher than they are now. The rational thing to do in such a situation would be to buy now. When people and businesses start buying more, the global economy will get back on the path to sustainable growth.

Unfortunately, says Morgan Stanley chief economist Steve Roach, even if such an inflationary scenario did unfold (and he doubts it can) it wouldn't solve the problem that got the world into its current fix. Simply put, the United States has become the world's buyer of last resort, the place that everyone else sells to, and this has resulted in a global overdependence on the U.S. economy.

"The fact that the world is going down the slippery slope of competitive currency devaluation is worrisome and indicative of the fact that the world can't figure out another way to grow," he said.

The endgame, he thinks, will be that Europe and Japan will ultimately be able to do nothing about the dollar's slide (besides complain), forcing them to undertake structural reforms -- like cleaning up the ailing banking system in Japan's case and reforming labor laws in Europe's -- that will allow them to grow on their own steam.

"It ends with a more balanced global economy which is terrific news," he said. "But it's going to be really hard to get from point A to point B."

|