NEW YORK (CNN/Money) -

U.S. stocks closed out a volatile week higher Friday, as bullish notes on Intel and Home Depot, along with decent earnings from General Electric, gave investors hope about the slew of second-quarter earnings due out in the next few weeks.

Friday brought the four-month anniversary of Wall Street's current rally, which started the day after stocks bottomed on March 11. Since then, as of Thursday's close, the Dow is up 21.2 percent, while for the year it's up 9.3 percent. The Nasdaq has gained 36.4 percent since then and is up 29.8 percent for the year. The S&P 500 has gained 24.6 percent since the bottom and has gained 13.4 percent for the year.

Bets that the second half of the year will bring increasing growth in the economy and corporate earnings and spending have sustained the rally so far. One stumbling block along the way could turn out to be the second quarter's corporate bottom line tally, with most S&P 500 companies set to deliver their results during the next two weeks.

In particular, "Next week is the big one for earnings," said Donald Selkin, director of research at Joseph Stevens. "You've got Microsoft, Intel, all the banks."

Next week alone brings earnings from eight members of the Dow industrials: Microsoft (MSFT: up $0.40 to $27.31, Research, Estimates) and Intel (INTC: up $0.43 to $23.34, Research, Estimates), as well as IBM (IBM: up $0.86 to $84.89, Research, Estimates), General Motors (GM: up $0.04 to $35.74, Research, Estimates), Coca-Cola (KO: down $0.10 to $43.91, Research, Estimates), Johnson & Johnson (JNJ: up $0.63 to $51.88, Research, Estimates), J.P. Morgan Chase (JPM: up $0.75 to $35.76, Research, Estimates), and Citigroup (C: up $0.95 to $46.15, Research, Estimates), which leads off the parade Monday.

Citigroup is forecast to have earned 80 cents per share, up from the 75 cents it earned a year earlier a year ago. (For a look at next week's most significant earnings reports and why they matter, click here.)

"I'd focus on Intel," said John Hughes, market analyst at Shields & Co. "If they can say something encouraging or at least, not discouraging, that could help the semiconductor sector sustain and build on the recent gains its seen."

Investors' reaction to this week's earnings reports has been mixed. Internet bellwether Yahoo!'s (YHOO: down $0.37 to $32.19, Research, Estimates) failure to surpass expectations led to the market's selloff Thursday. But Friday, news that General Electric's profit shrank for the third quarter in a row and its revenue came in short of forecasts failed to bring in sellers.

Many market watchers said the earnings period in general is likely to be positive and that most companies should meet or beat expectations. First Call is currently expecting earnings for the members of the S&P 500 to grow 5.3 percent from a year earlier. But there is some concern as to whether that will be enough to sustain the kind of stock buying that the market has enjoyed for months.

"I think you're going to see stocks moving in fits and starts over the next few weeks, within a broader range," Shields & Co.'s Hughes added. "We're still in an upward trend, but we're going to continue to be prone to getting hit by earnings misses, or someone's forecast disappointing."

Friday's market

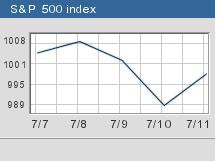

The Nasdaq composite (up 18.07 to 1733.93, Charts) gained just more than 1 percent, while the Dow Jones industrial average (up 83.55 to 9119.59, Charts) and the Standard & Poor's 500 (up 9.44 to 998.14, Charts) index both gained just under 1.0 percent, off their best levels of the session, but still decidedly positive.

For the week, the Dow gained 0.5 percent, the S&P 500 gained 1.3 percent, and the Nasdaq managed a substantial gain of 4.2 percent.

General Electric (GE: down $0.07 to $28.12, Research, Estimates) reported earnings of 38 cents per share, in line with estimates but down from 44 cents a year earlier due to fewer gas turbine shipments. GE also narrowed its forecast for the full year to the lower end of its current range. The stock closed fractionally lower.

Home Depot (HD: up $0.74 to $33.17, Research, Estimates) rose for 2.3 percent after Banc of America Securities raised its rating on the stock to "buy" from "neutral," saying Home Depot is a better operating company than it has been in years, and as a result, sales should show solid improvement in the second quarter and beyond.

Buying in big-cap technology shares also added to the gains. Intel (INTC: up $0.43 to $23.34, Research, Estimates) rose 1.9 percent, partly on an upgrade from Thomas Weisel Partners to "outperform" from "peer perform" on increased optimism that a business spending recovery is nearing for the sector. Additionally, Hewlett-Packard (HPQ: up $0.81 to $22.86, Research, Estimates) gained 3.7 percent and IBM (IBM: up $0.86 to $84.89, Research, Estimates) gained 1 percent after two brokerages began coverage on the stocks. CIBC World Markets started both with a "sector perform" rating and Prudential started both with a "buy" rating.

In other news, cable operator Charter Communications (CHTR: up $0.92 to $4.90, Research, Estimates) rallied 23.1 percent and was the Nasdaq's No. 1 most-active issue after the firm said it would raise $1.7 billion in the bond market as a means of refinancing older debt.

Sonus Networks (SONS: up $1.38 to $7.10, Research, Estimates) rallied 24.1 percent in active Nasdaq trade after the firm reported a narrower second-quarter loss and announced a deal with Verizon (VZ: up $0.67 to $38.77, Research, Estimates).

On the downside, Altria (MO: down $1.39 to $41.81, Research, Estimates) and others in the tobacco sector declined after a Wall Street Journal report highlighted comments from Moody's Investors Service saying that big cigarette makers will continue to feel the burn of discount brands. Altria also continued to be weighed down by concerns raised earlier in the week about the amount of money it will have to post to appeal an Illinois verdict. Altria shares lost 3.2 percent.

In the morning's economic news, the producer price index (PPI), a measure of inflation at the wholesale level, rose 0.5 percent in June. Forecasts were for a rise of 0.3 percent after falling 0.3 percent in May. The core producer price index, which excludes volatile food and energy prices, fell 0.1 percent, when analysts expected it to show a rise of 0.1 percent, after rising 0.1 percent in the previous month.

"This is an example of the resiliency of the market, of what has driven stocks higher for months. You've got PPI, GE, not so great, but they find a positive angle and take the market up," said Hughes.

Market breadth was positive. Almost 11 stocks rose on the New York Stock Exchange for every five that fell on volume of 1.20 billion shares. On the Nasdaq, where 1.50 billion shares changed hands, the advance/decline ratio stood at five to three.

Treasury prices rose, sending the 10-year note's yield down to 3.63 percent from 3.67 percent late Thursday. The dollar was higher against the euro and weaker against the yen.

NYMEX light sweet crude oil futures rose 28 cents to $31.05 a barrel. COMEX gold rose 50 cents to $345.10 an ounce.

|