SAN FRANCISCO (CNN/Money) -

When I went online Monday morning and read that Roxio had finally announced a launch date (holiday season 2003) for its Napster 2.0 legitimate music-download service, I promptly clicked over to an investment site to see how the company's stock price was moving on the news.

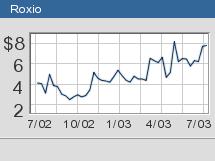

What I saw nearly caused me to spew coffee all over my monitor. For a time on Monday, the stock soared and briefly established a new 52-week high. It closed slightly down on the day, but by press time on Tuesday, it had again begun to head north on higher-than-normal trading levels.

Clearly, investors are jazzed about Roxio's (ROXI: Research, Estimates) potential to emulate Apple (AAPL: Research, Estimates) and its success with launching the iTunes music service.

On paper, Roxio's prospects look decent: It has deals with all the major music labels, it will offer the largest selection of legal music available online (500,000 songs), and it will launch with a brand that was en fuego a few years ago -- Napster. Based on the trading activity and the stock's general upward direction, it appears investors are bullish on Roxio.

While it's too early to tell how Roxio -- and other major players -- will fare in the Windows-based arena for legitimate music-download services, the company's success is far from guaranteed. Investors who blindly rush in do so at their own peril.

Challenges ahead

Roxio faces three big hurdles before it can taste success with Napster 2.0. The biggest challenge it faces is securing user-friendly licenses from the labels. This (coupled with highly effective advertising) was Apple's iTunes coup. Because the Apple market is so small, the music labels were willing to loosen their typically iron grip on album-content licenses.

Right now, the only existing Windows-based à la carte download service, the newly launched BuyMusic.com, is saddled with Byzantine licensing stipulations: One song can be copied to a device, while another can't, and one song can be shared among three computers, while another may be shared with only one.

"From a branding and marketing perspective, it's stupid to have different [licenses from each label]," admits Scott Blum, CEO of BuyMusic.com. "It's the biggest issue we have."

Though the licensing restrictions hampering BuyMusic.com are significant, they're less stringent than those found in the first generation of subscription-based online music services, such as MusicNet and Pressplay. Perhaps by the time Napster 2.2 comes around, the labels will be more accommodating with their licenses.

| Recently in Tech Biz

|

|

|

|

|

Roxio's second challenge is how it will market Napster 2.0. Roxio CEO Chris Gorog (who couldn't be reached by press time) often cites the brand value Napster has retained in the two years since its demise.

But Napster is a loaded name and conveys a somewhat convoluted message (Napster's back, but you have to pay to play).

"[The Napster brand] will draw users to the site, but it won't necessarily encourage them to stay there," says Susan Kevorkian, an analyst with IDC. "An effective marketing campaign will be incredibly important for Roxio."

Roxio's final challenge is the quickly growing competitive market for à la carte music-download services. By the time Roxio launches its services, the Windows-based legitimate download space should be vibrant.

BuyMusic.com has already launched and is offering prices as low as 79 cents per song and $7.95 per album. Apple has announced that it will have a Windows version of its store up and running before year's end. And the scuttlebutt is that companies such as Amazon (AMZN: Research, Estimates) and Yahoo! (YHOO: Research, Estimates) are looking into creating their own download services as well.

With the tech sector booming like it's 1999 these last three months, it's understandable that investors would instinctively jump when they hear the name Napster. But Roxio has yet to prove that it can bring the brand back to its former lofty perch in the digital music world.

Final notes

In my discussions on Monday with BuyMusic.com's Scott Blum, he stated that BuyMusic.com was "on the verge of a solution to the [licensing] problem," and that a solution had been reached just that morning. He further divulged only that it was a digital-rights-management solution created by BuyMusic.com and that all five major labels had agreed to it. He said that once the contracts were signed in 30 days, we'd hear more about it. Roxio investors should watch this closely.

Prediction: BuyMusic.com has been strangely adamant about using Microsoft (MSFT: Research, Estimates) products, touting the .Net infrastructure, the benefits of Windows Media 9, and the fact that the only way to visit its site is by using Internet Explorer. Look for Microsoft to acquire this company or make a significant cash investment sometime this year.

Sign up to receive the Tech Biz column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|