NEW YORK (CNN/Money) -

When cable provider Charter Communications pulled its $1.7 billion debt refinancing last week, few on Wall Street paid attention.

A massive power outage had engulfed eight states and parts of Canada, leaving the already thin summer trade even thinner. As a result, the possibility that Charter's decision could be a signal that a major setback is looming for the junk bond boom went almost unnoticed.

But this may change. The recent spike in Treasury yields and the lingering oversupply of junk bonds -- high-yielding, high-risk corporate debt -- has taken its toll. The window that helped companies like Dynegy stave off bankruptcy and Charter refinance debt over the last few quarters may have shut, at least temporarily. This is no disaster right now, but it could hurt the economic recovery over the next year.

"The danger is not so much in the next few months, as a lot of the companies that had needed to refinance for this year have done it already, like El Paso," said Kingman Pennimen, president of high-yield research firm KDP Investment Advisors. "But where you need to watch is in the next 12 to 18 months."

If the economy fails to recover enough before the companies' next round of debt refinancing, Pennimen said, they could face some big problems. Less corporate spending and a disruption in the market are just some of the risks, but the absolute worst-case scenario would be a spate of bankruptcies from companies unable to refinance their debt.

Charter backs off

Junk bonds were particularly popular with yield-craving investors in the first half of the year when Treasury yields were paltry.

Sensing that it would face rising Treasury yields if it didn't act fast, Charter (CHTR: Research, Estimates), along with a number of other companies, began planning a bunch of offerings in late June. But its timing was off.

In July, increasing signs of a recovery and worries that the mortgage boom was near its end sent Treasury yields surging. By last week -- the time Charter's refinancing was set to hit the market -- investors were already looking to put their money somewhere else instead of junk.

Charter first tried to up the yield on its offering, but then just postponed the refinancing altogether, citing the tough market conditions. In a statement, the company's chief executive said the firm will revise the transaction at a later date as the market improves.

But the market is unlikely to return to its earlier glory in the near-term.

"Investors are saying, 'we're not getting as much for the risk, so we're not interested,'" said Brian Reynolds, chief bond strategist at Kirlin Securities.

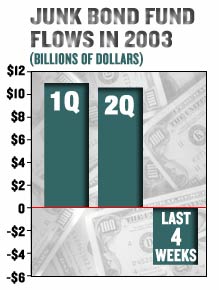

Case in point: in the first half of the year, inflows to junk bond funds were $21 billion, according to AMG Data Services, which tracks fund flows and holdings. In the last four weeks, $5 billion flowed out of these same funds.

Following Charter, on Tuesday, Oxford Automotive postponed its $240 million two-part junk bond offering. In the last month, grocer Gristede's and camera maker Panavision postponed their offerings as well.

With many people on vacation in late August on both the buy side and sell side, it's going to be hard to get a better sense of market sentiment and the impact of this for the time being, analysts said.

But there are a few key things to watch over the next few weeks and months to determine if the corporate bond market has worsened enough to pressure financial markets. Among the factors Reynolds is looking at: will more deals get pulled from the market and the volume of corporate bond deals that do go to market.

|