NEW YORK (CNN/Money) -

Stocks managed to chalk up gains on Thursday, with the Nasdaq reaching another 16-month high, as some buyers chose to enter the market on the back of better economic reports.

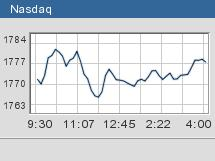

The Nasdaq composite (up 17.01 to 1777.55, Charts) rose 1 percent, helped by a boost in the chip sector. The tech-heavy index set a new 16-month high. The Dow Jones industrial average (up 26.17 to 9423.68, Charts) and the Standard & Poor's 500 index (up 2.97 to 1003.27, Charts) each scored gains of about 0.3 percent. The S&P ended at its highest point in more than a month.

Earlier in the week, the Dow reached a new 14-month high -- leading some investors to take profits Wednesday. But Thursday some investors saw the improving data on the labor market and Philadelphia-area manufacturing as a reason to buy. A continuation of the week's chip sector rally also helped aid gains in the broader market.

"Investor psychology is switching from fear to a little bit of greed. What you see is psychology working here today," said Michael Carty, principal at New Millennium Advisors.

Throughout the second quarter, stocks rallied on investors' hopes that the second half of 2003 would bring stronger signs of an economic recovery. But that rally fizzled as the markets entered the traditionally slow summer months.

After the closing bell Thursday, some retailers garnered attention. Nordstrom (JWN: up $0.32 to $24.00, Research, Estimates) posted second-quarter earnings of 48 cents a share, up from 27 cents in the same period last year and beating analyst estimates by 9 cents a share, according to Reuters Research. Gap (GPS: up $0.22 to $19.65, Research, Estimates) reported a quarterly profit of 22 cents a share, a penny better than Wall Street's average estimate and up from 6 cents in the year-earlier period. Both retailers gained more than 1 percent in Thursday trading.

With a lack of any major earnings or economic reports set for Friday, the markets could choose to trade within their recent range. The major indexes all had a jump on the week, with the Dow up more than 100 points, the Nasdaq up 75 point and the S&P 500 claiming gains of more than 12 points as of Thursday's close.

Economic data boost stocks

Giving the market a lift on Thursday, the Philadelphia Fed said its index of manufacturing in the mid-Atlantic region rose to 22.1 in August from 8.3 in July. The reading was more than double the rise to 10 expected by economists surveyed by Briefing.com.

Before the market opened, the Labor Department said the number of claims for unemployment benefits last week fell to 386,000 from an upwardly revised reading of 403,000 in the prior week. Economists, on average, had expected 395,000 new claims, according to a Reuters poll. Claims for unemployment benefits have come in below the key 400,000 level that has traditionally signaled an expanding labor market in four of the past five weeks. Thursday's reading was the lowest since February.

Stocks took a temporary dive in late-morning trading, which some traders had attributed to a rumor on the trading floor that the Goldman Sachs futures desk had made an error. But the Chicago Mercantile Exchange told CNNfn that there had been no erroneous trades reported in the stock index futures market Thursday.

Back to tech

Technology stocks got a boost after Intel CEO Craig Barrett said he saw a possible turnaround in personal computer sales, according to Dow Jones Newswires. Meanwhile, the Semiconductor International Capacity Statistics group said use of chip factories rose above 85 percent in the second quarter.

Lehman Brothers' upgrade of European semiconductors and equipment to "positive" from "neutral" also aided the chip sector. Intel (INTC: up $0.03 to $26.39, Research, Estimates) tipped higher, while the Philadelphia Semiconductor Index jumped 3.2 percent.

"The market is definitely showing a lot of resiliency, although we are seeing some profit-taking," said Hedi Reynolds, head of Nasdaq trading at Morgan Keegan.

A few leftover names were on the docket to release their quarterly earnings Thursday. Doughnut chain Krispy Kreme (KKD: down $1.42 to $47.50, Research, Estimates) tumbled 2.9 percent despite posting quarterly earnings that beat Wall Street's average expectation. J.P. Morgan cut its rating on the company to "underweight" from "neutral," citing production, long-term growth, and valuation concerns.

Foot Locker (FL: up $0.75 to $16.11, Research, Estimates) jumped 4.9 percent after posting better quarterly earnings.

Meanwhile, Walt Disney (DIS: down $0.38 to $21.60, Research, Estimates) was one of the Dow's biggest losers, slipping 1.7 percent after the company's largest shareholder, Walt Disney's nephew, Roy Disney, said he would sell 40 percent of his stake in the media and entertainment conglomerate. The sale would make Chairman and CEO Michael Eisner the biggest shareholder.

Market breadth remained positive. On the Nasdaq winning stocks overtook losers by nearly two to one as 1.7 billion shares changed hands. On the New York Stock Exchange advancing issues also outnumbered decliners by about two to one. Some 1.4 billion shares traded on the NYSE.

In other news, reports that Ali Hassan al-Majid, known as "Chemical Ali" and No. 5 on the list of most-wanted Iraqis, was in U.S. custody also added positive sentiment to the market. (For more, go to CNN.com.)

European markets ended higher Thursday. Asian stocks also finished on an up note. (Check the latest on world markets.)

Treasury prices sank after the Philly Fed data, sending the 10-year note yield up to 4.47 percent from 4.44 percent late Wednesday. The dollar gained against the euro, but was lower versus the yen.

NYMEX light crude oil futures rose 84 cents to $31.88 a barrel, while COMEX gold tumbled $5.20 to $361.80 in New York.

|