NEW YORK (CNN/Money) -

They're annoying, they're costly, and they're slowing down the Internet, hindering people's ability to keep track of Anna Kournikova, but the recent worm and virus attacks aren't hurting the U.S. economy much, if at all, economists said Friday.

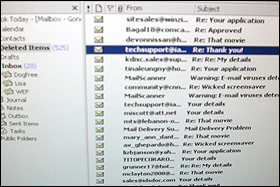

In just the past two weeks, millions of computer users around the world have been bothered by the SoBig worm, the fastest-spreading e-mail bug ever; the MSBlast worm, which attacked several thousand Microsoft operating systems, and the Nachi worm, apparently intended to fight MSBlast, which has slowed down thousands more computer systems.

|

|

| The SoBig worm has flooded millions of e-mail boxes with spam. |

The viruses have hamstrung operations at several businesses, including railway operator CSX (CSX: Research, Estimates), airline Air Canada and defense contractor Lockheed Martin (LMT: Research, Estimates). Computer security experts told CNN/Money the cost of fixing the damage from SoBig alone could be about $50 million.

To the extent that they force businesses and workers to waste time deleting tons of spam e-mail or loading anti-virus software, the bugs could shave about half a percentage point from productivity growth in the quarter, said Anthony Chan, chief economist at Banc One Investment Advisors.

"Anything that causes people to spend more time thinking about what they do will clearly have an impact on productivity," Chan said. "The good news is this is not a permanent situation -- these things have a way of clearing themselves up. But will it be completely inconsequential? I don't think so."

Productivity, a measure of worker output per hour, is a big deal for the economy, since it lowers the cost of doing business, boosting corporate profits and improving standards of living.

Fortunately, with recent advances in technology and the longest period of labor-market weakness since World War II, productivity growth has plenty of room to fall. It grew at a stunning 5.4 percent rate last year, the fastest pace since 1950.

| Related stories

|

|

|

|

|

What's more, a lot of the money businesses are spending on anti-virus software or hiring consultants to safeguard systems goes right back into the economy -- it might even create a job or two, Chan said -- though it seems unlikely this would totally offset the negative effects.

"With the disruption of airlines, trains and such, it's hard to make the case that increased business at anti-virus companies would be totally offsetting," said James Glen, senior economist at Economy.com.

Of course, most economists doubt the worms' impact, for good or bad, is really that great at all, in part because the worms, which typically don't destroy files, aren't doing any permanent damage, and most businesses have already safeguarded themselves to a large degree.

"If we were starting from scratch and had to put all these systems in, that would be costly, but the incremental cost of making sure we have the latest version of protection against the latest version of a virus is not really that much," said Ken Goldstein, an economist at the Conference Board, a private research group in New York.

Still, it seems to be just another of the many speed bumps that have suddenly appeared on the road to the economic recovery, and the increase in business spending, that many economists are expecting in the second half.

Some of them are minor -- such as the worms and the recent blackout in the Northeast -- while others are more worrisome -- such as lingering high oil prices and rising interest rates.

"Right now, the worms are just an irritant, but there are a lot of weird things happening -- worms, bomb blasts [in Baghdad and Jerusalem] -- that are not good for the morale of executives," said Rajeev Dhawan, Director of the Economic Forecasting Center at Georgia State University in Atlanta. "If that takes a hit, the much-vaunted recovery in business investment might get delayed."

|