NEW YORK (CNN/Money) -

Earnings hopes are high. So are valuations. Now all the technology sector has to do is deliver on the lofty promises.

For technology companies, the second half of the year is usually stronger than the first. In addition to the back-to-school and holiday shopping seasons, big corporations typically spend more of their tech budget in the latter half of the year.

But will it be strong enough to justify the big rally that's already taken place?

|

|

| The Nasdaq is outperforming other major market barometers. |

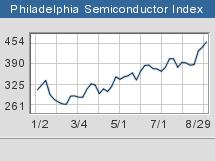

The Nasdaq is up nearly 35 percent this year. The Philadelphia Semiconductor Index has surged 57 percent. And the Dow Jones Internet Index has soared more than 66 percent.

Though the overall economy seems to be picking up steam, the jury is out on whether that will yield higher levels of corporate information technology spending.

"I'm still a little cautious," said Richard Williams, strategist for Summit Analytic Partners, an independent research firm.

Earnings need to be really good

On the one hand, semiconductor kingpin Intel (INTC: Research, Estimates) started the earnings preannouncement parade on a positive note when it said in late August that third quarter sales and margins would be significantly stronger than it originally anticipated.

But to justify the sector's valuations, more companies will need to follow Intel's lead. "Tech companies are going to have to keep raising estimates in order to maintain this type of momentum," said Adam Adelman, senior technology analyst with Philippe Investment Management, a New York-based money management firm.

|

|

| Chip stocks are enjoying an incredible run in 2003. |

Not helping was the recent forecast from chip equipment company Novellus Systems (NVLS: Research, Estimates). The company said in its mid-quarter conference call Thursday that it expects to break even in the third quarter on sales of $215 million to $220 million. Although that was in line with analysts' expectations, investors were hoping that Novellus would up its guidance. It also said it would take a $70 million restructuring charge to write-off inventory. The stock tumbled nearly 3 percent Friday morning.

Adelman said investors would also need to examine the quality of earnings, particularly when it comes to currency. Many large tech companies, such as IBM (IBM: Research, Estimates), Hewlett-Packard (HPQ: Research, Estimates) and Intel reported relatively solid second quarter results due in large part to a weak dollar, which lifted the value of international revenue. If the dollar continues to rally, that could hurt earnings for large techs.

Still, some think that large tech stocks were oversold coming into this year and have some more room to run, regardless of what happens with the economy and earnings. "For some tech companies, things went way overboard on the downside," said Michael Cuggino, president of Pacific Heights Asset Management, which runs the Permanent Portfolio family of mutual funds.

But Cuggino said the key is sticking with quality names in the sector, and not speculative bets that are losing money. Among his top tech holdings, Cuggino cites Intel, security software firm Symantec (SYMC: Research, Estimates), storage software developer Veritas (VRTS: Research, Estimates) and contract manufacturer Sanmina-SCI (SANM: Research, Estimates) as solid long-term investments.

Keep an eye on M&A and IPOs as well

In addition to earnings, the health of the tech merger and IPO markets will go a long way towards determining whether this rally is for real.

After a spate of deals in the early summer -- PeopleSoft buying J.D. Edwards, EMC agreeing to purchase Legato Systems and Yahoo! announcing its intent to acquire Overture Services, to name a few -- the mergers and acquisition environment has cooled down.

If the slump continues, that's not a good sign. Consolidation would help rid the tech sector of some of the excess capacity built up during the last bubble. And a pickup in the pace of mergers could also lift stock prices further as investors bet on more deals.

| Here's what tech did on its summer vacation

|

|

|

|

|

There was some encouraging news on the M&A front before the long weekend. On Thursday, communications chip firm Applied Micro Circuits announced a $190 million deal for storage infrastructure company JNI Corp.

Sure, it's a small deal, but Applied Micro did agree to pay a 20.6 percent premium to JNI's closing price, not an insignificant sum.

Likewise, the early part of the summer was a fairly decent one for tech IPOs with healthy receptions to offerings from chip testing firm Form Factor, consumer electronic plays Digital Theater Systems and InterVideo and wireless infrastructure firms iPass and Netgear.

This fall, no blockbuster tech IPOs are on tap. But semiconductor companies AMIS Holdings and SigmaTel could do reasonably well and enterprise software developer Open Solutions, which filed on Thursday, looks intriguing.

But the whole tech world is hoping and praying for a filing by search engine Google, which is likely to generate the most excitement for an IPO since the days of the bubble. If Google goes public, that could spark a new interest in tech IPOs just as eBay did when it went public in 1998.

|