NEW YORK (CNN/Money) -

U.S. stock markets closed lower on the day and the week Friday, with a selloff following Microsoft's lukewarm forecast in sync with a week during which mostly upbeat earnings were met with indifference.

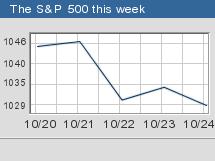

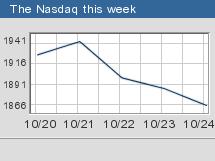

The Nasdaq composite (down 19.92 to 1865.59, Charts) fell almost 1.1 percent. The Dow Jones industrial average (down 30.67 to 9582.46, Charts) lost 0.3 percent and the Standard & Poor's 500 (down 4.86 to 1028.91, Charts) index fell 0.5 percent.

On the upside, the major indexes had been much lower until the last hour of trading. Some buyers jumped in before the weekend, suggesting that sentiment remains pretty upbeat.

Microsoft was just the latest company in the earnings reporting period to issue results and a forecast that was mostly positive, but not necessarily over the moon, and see its stock slide in response.

"Earnings news has been discounted and investors are looking for a reason to take money off the table," said Peter Cardillo, director of research at Global Partners Securities. "Today, they found that reason in Microsoft's sales projections."

More than 60 percent of the Standard & Poor's 500 companies have reported quarterly results and, on average, the results are up around 22 percent from a year earlier, according to First Call/Thomson Financial. But after sending stocks soaring this year on bets that the earnings would be good, investors have shown reluctance to push the market any higher, and have been taking profits for the last week.

Stocks closed lower on the week, the first in four for the Dow and S&P, and the second in a row for the Nasdaq. On the week, the Dow lost 1.4 percent, the S&P 500 lost 1 percent and the Nasdaq lost 2.4 percent.

"We've had an incredible run this year, and a lot of that runup was in anticipation of the good earnings, so you're having some selling on the news," said Michelle Clayman, chief investment officer at New Amsterdam Partners. "But the fourth-quarter should be good for stocks and I think we'll manage some more modest gains by the end of the year."

Year-to-date as of Friday's close, the Nasdaq is up 36.7 percent, the Dow is up 14.9 percent and the Standard & Poor's 500 index is up 16.9 percent.

"I suspect over the next session or two, we could see more selling, as investors await all the economic news due next week," Cardillo added, saying that the most market-moving reports of the week are likely the first quarter read on gross domestic product, consumer confidence, and the Chicago PMI.

The latest decision and accompanying statement from the Federal Reserve will also draw attention on Tuesday.

Monday's economic reports include new and existing home sales, both expected to decline; they are due out after trading begins. Earnings are due Monday before the bell from Dow components International Paper (IP: down $0.57 to $38.44, Research, Estimates) and Procter & Gamble (PG: up $0.91 to $96.06, Research, Estimates) and then American Express (AXP: down $0.01 to $47.62, Research, Estimates) during the session. For a more detailed look at next week's earnings reports, click here.

Friday's market

After the close of trade Thursday, Microsoft (MSFT: down $2.30 to $26.61, Research, Estimates) reported better-than-expected earnings of 30 cents a share, up from 28 cents a year earlier and a penny better than expected, on revenue that also grew from a year earlier and topped estimates.

However, the company's guidance for the current quarter and full year disappointed investors, despite the fact that it was higher than analysts currently are looking for. In addition, the company said it did not see much of a pickup in technology spending. The software titan also reported unearned revenue, sales from software license renewals that the company expects in future quarters, that was much lower than in the previous quarter. The stock tumbled nearly 8 percent.

"You've clearly got some selling on the news," said Michelle Clayman, chief investment officer at New Amsterdam Partners. "Microsoft wasn't bad at all, but it wasn't as bullish as some people were hoping."

Shares of JDS Uniphase (JDSU: down $0.18 to $3.60, Research, Estimates) fell 4.8 percent in active Nasdaq trade after the fiber-optics gear maker reported a fiscal first-quarter loss that was narrower than expected on revenue that missed expectations. The company issued a current-quarter forecast that is in a range that will either meet or miss expectations.

Nortel Networks (NT: down $0.29 to $4.15, Research, Estimates) reported better-than-expected earnings after the close Thursday that rose from a year earlier on revenue that declined. The company also said it will restate results for 2000, 2001, 2002 and the first half of 2003 following a review, and that the impact would be a reduction of net losses during that period. Its shares shed 6.5 percent.

The pressure from JDS and Nortel, in connection with a downgrade, sent Lucent Technologies (LU: down $0.17 to $2.66, Research, Estimates) sliding 6 percent. Deutsche Bank Securities cut its rating on the stock to "sell" from "hold."

But on the upside, a strong earnings report and some bullish analyst calls sent Extreme Networks (EXTR: up $1.20 to $8.27, Research, Estimates) 17 percent higher.

In other news, BellSouth (BLS: down $0.09 to $25.83, Research, Estimates) and AT&T (T: up $0.74 to $19.90, Research, Estimates) had merger talks this week, the Wall Street Journal reported. The two have tried unsuccessfully to partner in the past but began negotiations again amid MCI's pending emergence from bankruptcy-court protection, the paper said. BellSouth's stock was little changed, but AT&T climbed 3.9 percent after the news.

|

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

Nine stocks fell for every seven that rose on the New York Stock Exchange, where 1.42 billion shares changed hands. On the Nasdaq, losers beat winners by almost three to two on volume of 1.94 billion shares.

Treasury prices rallied, with the 10-year note gaining 21/32 of a point and its yield moving down to 4.23 percent from 4.31 percent late Thursday. The dollar gained slightly against the yen and euro.

NYMEX light sweet crude oil futures fell 14 cents to settle at $30.16 a barrel. COMEX gold futures gained $4.20 to settle at $388.90 an ounce.

|