NEW YORK (CNN/Money) -

Abercrombie & Fitch may not have a problem with controversy, but it does seem to have a problem with cannibalization.

The retailer, known for racy catalogs and on-the-edge fashion, is on a 10-month losing streak in its sales this year. Wall Street punished the stock Thursday and analysts raised red flags about its prospects.

"That's a pretty long stretch, and investors are concerned that earnings could take a hit unless sales improve," said Ken Perkins, retail analyst with Thomson Financial.

The latest numbers aren't encouraging. Abercrombie said November sales at stores open at least a year -- a key retail measure known as same-store sales -- fell 13 percent, much deeper than analysts' estimates of a 5 percent drop.

On the heels of the news, Abercrombie (ANF: Research, Estimates) shares fell $2.67, or over 9 percent, to $24.61 on the New York Stock Exchange.

|

|

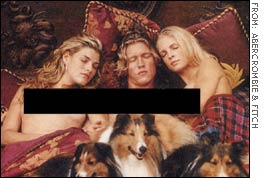

| Advocacy groups blasted Abercrombie for featuring pictures such as this in its 2003 holiday catalog, saying it promotes sexual promiscuity. |

J.P. Morgan analyst Brian Tunick warned last month that the company's double-digit earnings-per-share (EPS) growth rate was in jeopardy unless it could improve its sales trend. He downgraded the stock Thursday to "neutral" from "overweight."

Tunick's big concern is over slumping sales in Abercrombie's namesake stores as well as in its Hollister clothing division.

Other observers fret that instead of the two units drawing more business into the overall Abercrombie operation, they're just fighting over the same customers and robbing each other of sales.

"With [A&F's trendy clothes unit] Hollister posting its second-consecutive month of negative comparable sales and the core A&F business below expectations again, our positive thesis on the A&F story has clearly been put to the test," Tunick wrote in a research report.

The New Albany, Ohio-based retailer runs 173 Abercrombie stores and 164 Hollister Co. stores around the country. It credited new store openings for its total net sales of $161.2 million for the four-week period ended Nov. 29, up slightly form $158.7 million a year ago.

Out of sales

Another area of concern is Abercrombie's unwillingness to use discounts and sales promotions to lure teens and young adults into its stores ... ironic given the retailer's penchant for eye-raising marketing.

Merrill Lynch analyst Mark Friedman said in a Thursday research note that he had expected the company "to take more aggressive action to kickstart the holiday season. While they mailed 15 percent-off coupons to begin the Thanksgiving weekend, this was not enough to get the consumer enthused." Friedman downgraded A&F to "neutral" from "buy".

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

|

In a pre-recorded sales message, Abercrombie said it would maintain its "understated promotional posture" even though it admitted that the lack of discounts did hurt its November sales.

Both Tunick and Friedman questioned that policy.

"We think management's ongoing thought process of 'protecting the ANF brand' with its non-promotional stance is not the way to win in this highly-competitive teen market," Tunick said.

Friedman, however, flagged a few more concerns.

"What is ailing Abercrombie? Is it Hollister cannibalization? Is it competition? Is it saturation? We believe it is a combination of all of these things," Friedman said.

|

|

| The cover of the latest A&F catalog shows the retailer isn't shy to court controversy. |

"It's likely that the brand is a bit stale and needs updating. There are new updated hot items in the store, but Abercrombie and Hollister are fashion brands, and thus the need to capitalize on changing trends is critical," Friedman added.

Despite its sales woes, Abercrombie has managed to grow its earnings for 45 consecutive quarters because the company maintains very lean operations and doesn't do a lot of promotional pricing in order to preserve the brand image.

Separately, the retailer had many people guessing the reason behind its recent decision to recall Abercrombie's racy holiday catalog from all its stores. While Abercrombie told CNN/Money that it needed the space on the counter for a new perfume, one parents' advocacy group claimed the move was in response to its protests and call for a boycott of the retailer over the catalogs.

|