NEW YORK (CNN/Money) -

The end of the most successful marriage in Hollywood history could leave both partners better off for the divorce.

The announcement Thursday evening that Pixar Animation Studios and Walt Disney Co. would end talks on extending their collaboration sent Disney (DIS: Research, Estimates) stock down 1.8 percent and Pixar (PIXR: Research, Estimates) shares up 3.4 percent Friday.

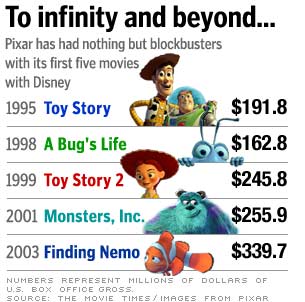

Some shareholders worried about the end of a deal that has brought more than $1 billion in profits to Disney. Meanwhile Pixar shareholders looked forward to the studio that has had nothing but hits being able to hang onto all future profits after 2006.

But numerous analysts say that Disney is better off for not having made the deal on the terms that Pixar, with its perfect record of producing hits, can now dictate. They said Disney would have had to give up some benefits from the existing deal in order to keep Pixar long-term.

"We believe the economics that Pixar was seeking were not beneficial to Disney," said Mike Kupinski, an analyst at A.G. Edwards, in a note. "We would view any weakness as a buying opportunity, as we believe Disney's fundamentals are improving."

Disney Chairman and CEO Michael Eisner is facing an attempt to oust him by Roy Disney, nephew of the company's founder. Roy Disney and former Disney board member Stanley Gold issued a statement Thursday saying the loss of Pixar is a serious blow to the company and further reason Eisner should be replaced.

|

| |

|

|

|

|

Pixar says it is ending talks with The Walt Disney Company to extend their existing five-picture deal. CNNfn's Fred Katayama reports. Pixar says it is ending talks with The Walt Disney Company to extend their existing five-picture deal. CNNfn's Fred Katayama reports.

|

Play video

Play video

(Real or Windows Media)

|

|

|

|

|

But several analysts said Friday they doubt that the end of the Pixar deal will build any support for the oust-Eisner effort, especially since the economic impact on Disney won't be seen until 2006 at the earliest and maybe not until a year or two later.

"We're second to none in our affection for Pixar. But their success quotient gave them great leverage," said Harris, Nesbitt, Gerard analyst Jeffrey Logsdon. "If [Disney] had agreed to what it would have taken to keep Pixar, the critics would have issued a statement saying they gave away the store."

What Disney keeps from letting the agreement expire is the right to make sequels, television series and other offerings based on the existing Pixar films, as well having two more movies under terms of the current deal -- "The Incredibles" due out in the 2004 holiday season and "Cars" due out next year.

|

|

| Any sequel to "Finding Nemo," the most successful animated film of all time, will come from Disney, not Pixar. |

"Disney may have lost considerably more had it agreed to Pixar's request, i.e. given up control to copyrights and sequels while agreeing to revised terms on the next two films," said a note from Merrill Lynch analyst Jessica Reif Cohen, who estimated that the agreement contributed more than 50 percent of Disney's film studio profits during the life of the agreement.

Reif Cohen said that since the current deal stays in place through 2006, she's not lowering estimates at this time.

Disney has already announced plans for making "Toy Story 3." While technically Pixar has the rights of first refusal on all sequels, it would have to again give Disney the lion's share of the profits from those films.

Disney on losing streak

Disney has had a pretty rough track record in animated movies in recent years. Since 1999's "Tarzan" came out, Disney has not had an animated movie that cracked the $150 million mark in domestic box office. It has a number of large disappointments during that period, such as "Treasure Planet" and "Atlantis."

| Related stories

|

|

|

|

|

Meanwhile Pixar has had three films cross the $200 million mark, including last year's "Finding Nemo," the biggest grossing animated film of all time. Dreamworks has had a $267 million hit in "Shrek" and is poised to release a sequel this spring. Fox hit $176 million in U.S. box office with "Ice Age."

All those animated hits from the other studios used computer generated or CG animation to produce films with more of a 3-D look than Disney's hand-drawn features.

But Disney has been gearing up with its own CG efforts. It has its first all-computer generated animated feature, "Chicken Little" due out in summer of 2005, and it has two other CG movies, "A Day With Wilbur Robinson," and "Rapunzel Unbraided," in the works, in addition to "Toy Story 3."

"We have long believed that the least discussed yet most important part of the partnership between Disney and Pixar was just that � the two companies worked together, not against each other," said a note from Schwab Soundview Capital Markets analyst Jordan Rohan.

"Going forward, at least after the 2005 release of Pixar's "Cars," the companies now become fierce competitors. Disney has the resources and now the motivation to compete with Pixar at the box office and on the home video shelves at Wal-Mart and everywhere else. In animated film, Disney is, in our view, a very formidable foe."

|