NEW YORK (Reuters) -

Treasury prices took a dip on Thursday after a key Federal Reserve official jolted the market with an upbeat jobs and growth forecast.

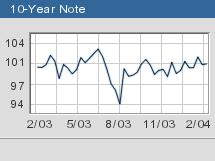

At around 4:00 p.m. ET, the benchmark 10-year note fell 15/32 of a point to 100-18/32 to yield 4.18 percent, up from 4.11 late yesterday, and the 30-year bond lost 1/2 of point at 105-21/32 with a yield of 4.99 percent, up from 4.97 percent late Wednesday.

The two-year note fell 4/32 of a point to 100-3/32 to yield 1.83 percent, while the five-year note shed 10/32 of a point to 100-9/32, yielding 3.19 percent. Bond prices and yields move in the opposite direction.

In the currency market, the dollar fell slightly against the euro but gained strength against the Japanese yen. The euro purchased $1.2539, up from $1.2533 late Wednesday. The dollar bought ¥105.90, up from ¥105.52.

After trading flat for much of the session, bonds flinched when Fed Board Governor Ben Bernanke said the U.S. economy should expand by 4 percent or more in 2004.

Even more worrying for bond bulls obsessing over Friday's January payrolls report, Bernanke said he was "pretty confident" the nation would soon see big numbers on employment.

Bernanke's optimism left the market wondering whether the central bank might be tempted to begin hiking interest rates sooner than is generally expected.

"You're seeing some good selling here and it's all based on Bernanke's comments," said Andrew Brenner, head of fixed income at Investec, Ernst & Co.

|

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

A jump in first-time jobless claims reported earlier put a floor on prices, heartening those worried that January payrolls would finally bring the burst of job creation that has so far eluded this economic recovery.

Jobless claims rose to 356,000 last week from a revised 339,000 the previous week, a surprise to analysts who had looked for a slight dip, offering some support to bonds.

Still, economists were sticking to their forecasts of around 150,000 new jobs in January after December's meager 1,000 addition to payrolls. Any surprises in either direction might wreak havoc on the market.

"People are nervous," Brenner said. "You could get some really violent moves tomorrow."

Accustomed to surprises from the monthly employment figures, traders usually prefer not to make any drastic moves ahead of such data.

-- from staff and wire reports

|